This question is prevalent among most homebuyers. After all, the past two to three years since Covid have seen prices reach new highs; and everyone from first-time buyers to HDB upgraders have been waiting for a break. The news is, to put it directly, a bit ambivalent – it doesn’t look as tough for buyers as it was in the aftermath of Covid, but it’s hardly a case where sellers are desperate either. Here’s a take on the market for 2024:

Overall price movements over the past year

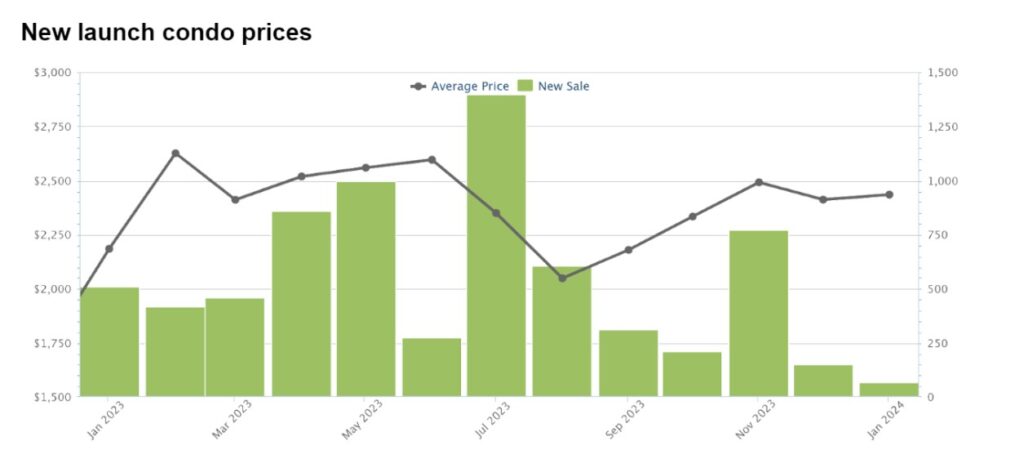

As I write this, we’re about one week away from the end of January – so while not all the transactions for the month are reflected yet, it’s close enough that we can include January in our numbers. Here’s how prices moved between January 2023 to the present:

New launch condo prices actually showed a dip between November and December and last year; but overall, prices are still higher than they were in January 2023. The price has moved from an average of $2,185 to $2,436 psf, up around 11.8%.

Resale condo prices

Resale prices have also risen since last year. Prices averaged $1,508 psf in January 2023, and they rose around 6.7% to $1,609 psf in January this year; a much more modest pace compared to new launches, but still higher.

With the current prices in mind, let’s look at some of the key factors we’ll encounter in 2024:

- Rising supply of private homes

- Higher occupancy cap for rental units

- Impact of higher ABSD

- Possible moderation in home loan interest rates

- Effect of harmonisation in GFA definitions

1. Rising supply of private homes

A significant number of new condos reached TOP last year; and some notable big projects are Treasure at Tampines, Normanton Park, and Parc Clematis.

Treasure is the biggest ever condo development in Singapore to date, putting 2,203 units into being; while Normanton Park and Parc Clematis are also sizeable at 1,862 units and 1,468 units respectively. Besides these, some 30+ projects, including Jadescape, Florence Residences, and others would have been completed last year, or soon in the coming months.

This is a huge step in correcting the supply crunch we had in 2023. At the time, low housing inventory, plus a surge in conditions like Work From Home, drove up prices in both the HDB and private markets; but we can see the situation is being corrected.

On top of the large numbers of built units, we’re expecting a good number of new launches in the coming year. Right now, estimates sit at around 40 new launches, introducing a possible 12,800 new units.

The increased supply is likely to apply downward pressure on prices, so it’s improbable that we’ll continue to see the explosive price growth we saw in the past two to three years. But given higher Land Betterment Charges, and the high prices of Government Land Sales (GLS) sites back from 2023 or earlier, there is a limit to how much developers can discount their products.

So while higher supply may slow price growth, those who expect big discounts from developers – or an average drop in new condo prices – will likely be disappointed.

2. Higher occupancy cap for rental units

The rental market was expected to soften in the coming year, due to the influx of new homes; then URA made an announcement that shook things up again. From 22nd January this year to 31st December 2026, the occupancy cap has been raised.

For private properties of at least 90 sqm. or larger, the landlord may now take on eight unrelated tenants, as opposed to six previously. Two extra tenants is quite a significant bump in rental income, and this more than compensates for the higher interest rates recently faced by landlords (see below).

It is now uncertain whether this move will incentivise more investors, or whether it will be handwaved as a temporary quirk. It may encourage landlords to go for larger units, as opposed to one-bedders, to take advantage of the higher occupancy cap; if so, this could put them in competition with families buying larger homes.

3. Impact of higher ABSD

The April 2023 cooling measures doubled ABSD rates on foreign buyers, raising it from 30% to 60%. This is one of the most aggressive disincentives we’ve seen to date, against foreign property buyers in Singapore.

While this may help to drive down prices, the expected impact is largely within the Core Central Region (CCR). This is because the CCR is where we tend to find the bulk of foreign buyers. We already saw some of the impact toward the end of last year:

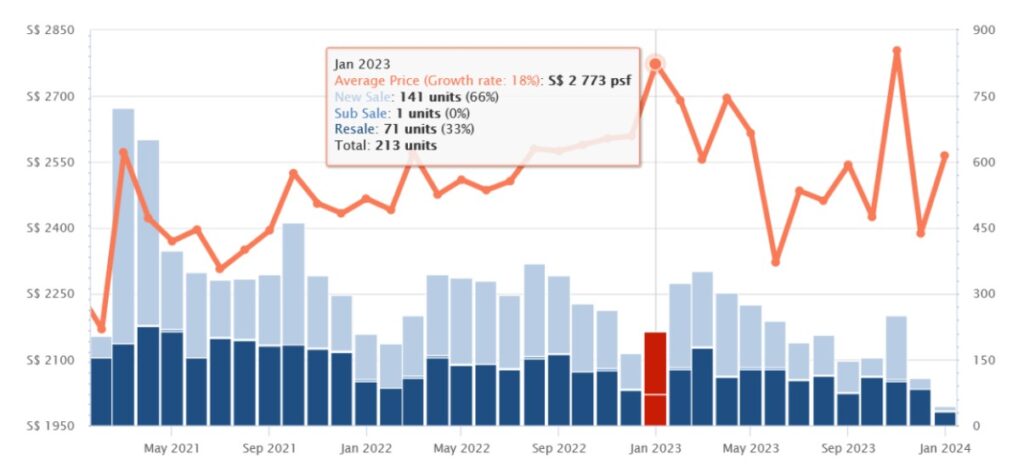

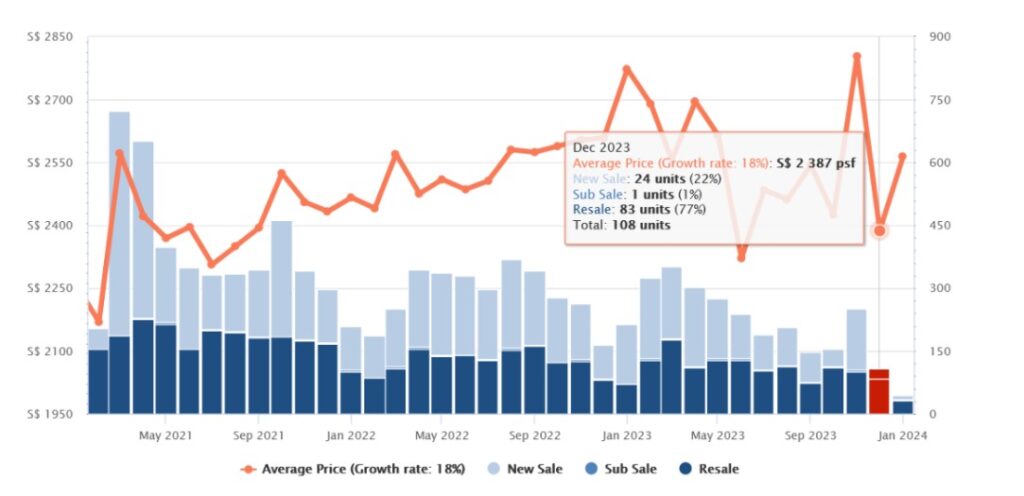

If we look at average prices in the CCR only, they averaged $2,773 psf in January 2023. The cooling measure was passed in April, and this is what happened by end-2023:

The price averaged had dipped to $2,387 psf, a decrease of around 14%.

Good news if you’re buying prime properties I suppose; but it’s not much help for the average home buyer in Singapore; not unless an Orchard or Shenton Road-area condo is high on your list.Replica-Uhren

In an ironic twist though, the higher ABSD rates may also result in fewer sellers being willing to part with their units, or demanding higher prices. For example: if you had two properties before the higher ABSD, and you sell one unit now, then in future you are going to have to pay ABSD on the second unit.

This can restrict supply and en-bloc sales, or raise resale prices, because some sellers are factoring in the cost of a replacement property.

4. Possible moderation in home loan interest rates

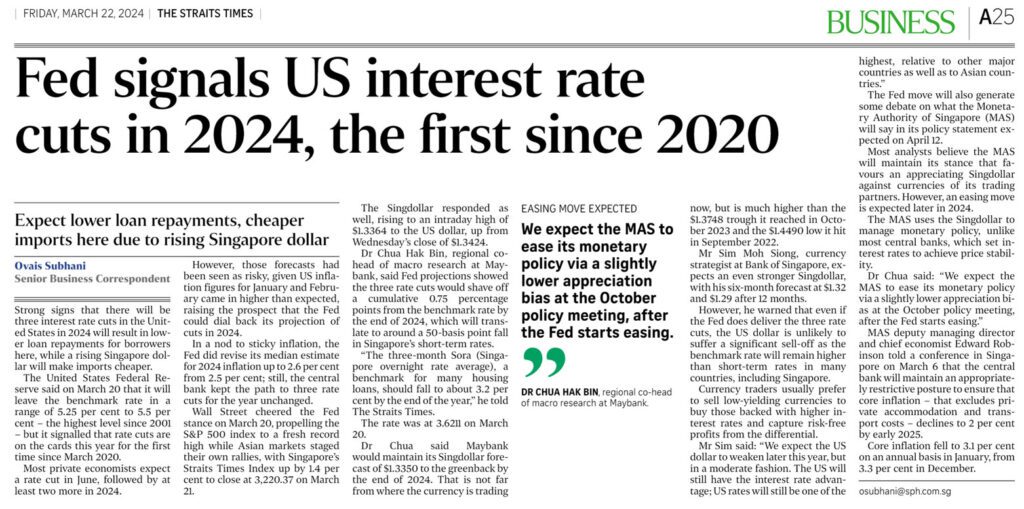

This one is entirely up to our friends in the United States. There has been some indication the US Federal Reserve may cut rates, possibly three times, in the coming year.

(In fact, the Fed did indeed send strong signals that there will be 3 interest rate cuts this year, as reported in the Straits Times on 22 March 2024).

Most home loan interest rates in Singapore are pegged to an index called SORA (this replaces SIBOR, which was previously used). SORA tends to move in tandem with US interest rates; so whether the Fed decides to raise or lower the rate, we’ll see a knock-on effect in Singapore.

Interest rates are now climbing close to 4%, a significant increase from Covid days when the rates were about half; and of course the higher the rate, the more you pay for your home (it also affects things like how soon you reach your CPF withdrawal limit).

Overall, talk of rate cuts form a good outlook for homebuyers.

(Note: For the uncommon few who use internal Bank Rates (BR), this is not as relevant to you, as your interest rate is set by your lender and not the wider market. But if the market rate rises, chances are your lender will raise their rate as well).

5. Effect of harmonisation in GFA definitions

URA has recently taken steps to harmonise the definitions of Gross Floor Area (GFA) among different agencies. Without going too far into the technicalities of this, we should note the most relevant impact on home buyers:

First, the new rules bring an end to strata void space. This is the empty air between the floor and ceiling, for which you previously may have had to pay (it counted toward the GFA). This has been done away with, much to the relief of most homeowners.

Second, some of the past shenanigans – such as building big air-con ledges and curtain walls – will come to an end. Previously, some developers liked to do this as it added square footage which the buyers had to pay for (but which the developers didn’t).

This is a double-edged sword for buyers, in the coming years. On the one hand, you will no longer waste money on useless features, like giant air-con ledges and bay windows; so layouts will be more efficient.

On the downside, this is actually a steep cost to developers, which cuts into their margins. So a potential consequence is that, while there’s no more space-wasting features, you may end up paying a higher price per square foot. Time will tell how this plays out.

All in however, I’d call it a net positive for those buying new launch condos, as your living space is better maximised. For those buying older condos though, I’d now be more careful to check on the square footage, as the information on these older projects may not have been updated yet (e.g., some older listings may still include strata void space in the total square footage).

As a general conclusion, home prices are likely to see some moderation, and not rise as fast as the post-Covid period.

However, expecting prices to go down is probably a stretch; it is likely that $2,000+ psf has been cemented as the new norm for a new launch. Also, going forward, Singaporeans will need to consider the much greater impact of home loan rates on their property purchases.

If you need help in the current market, or want to analyse your next best move based on your existing property, feel free to reach out to me.