The truth is: Not everyone can afford a condo! If you are considering buying a condo in 2024, you are faced with two challenging issues: a combination of high interest rates, as well as high home prices. This has led many to question whether buying a condo right now is affordable; or even if they’re now priced out altogether. This is a complex question with many factors, ranging from the size of the loan you’ll take, to the nature of your income – but let’s take a look at some ballpark figures and estimates:

The 3-3-5 about housing affordability

This is a rule-of-thumb which is also endorsed by CPF. The idea behind 3-3-5 is:

- The monthly loan repayment for your property should not exceed 30% of the combined borrowers’ income. This rule is enforced by HDB as the Mortgage Servicing Ratio (MSR), but for private property, you are given leeway to go beyond it (see below).

- You should have 30% of the property price ready in cash, before you attempt to buy. This is to ensure you don’t have to back out suddenly because you lack the funds for stamp duties, or other miscellaneous costs (backing out at the last minute can cause you to lose your deposit).

- The total price of the property should not exceed five times the annual income of the borrowers. This is straightforward but increasingly challenging, as many new launches are much pricier compared to a few years ago.

These constitute a good general guideline, but as always there may be exceptions. For example, those with variable income may want to set tighter limits, or those with sizeable cash reserves may be willing to go slightly past these boundaries.

Looking beyond the general guidelines however, here are some actual numbers to consider:

(Note that the following also applies to Executive Condominiums, as there is no HDB loan for ECs. You will have to use a bank loan that’s subject to the same conditions below.)

- Minimum downpayments

- TDSR limits and monthly loan repayments

- Stamp duties

- Miscellaneous costs

- best replica watches site

1. Minimum down payments

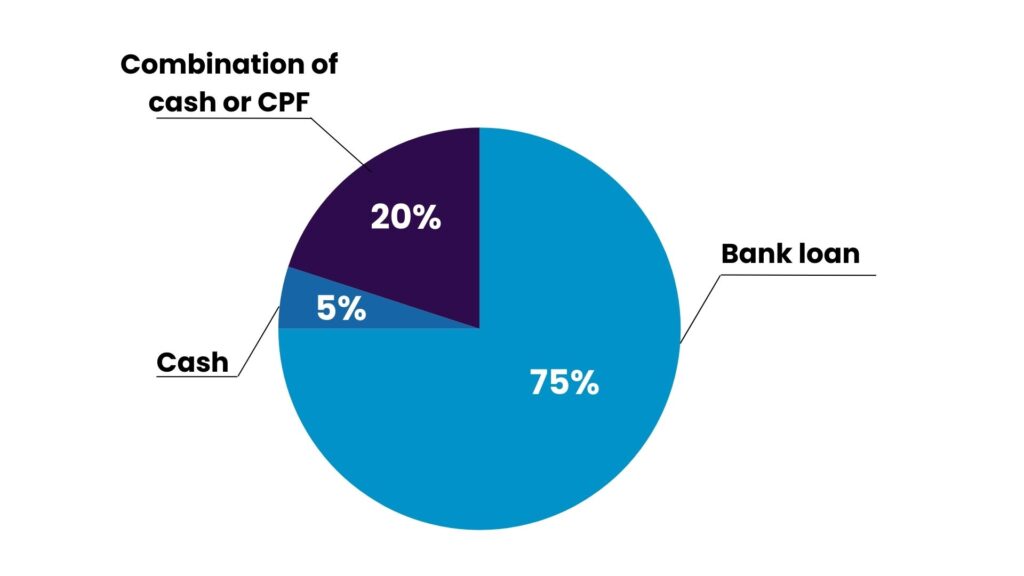

The minimum cash down payment on a private property is always five per cent. Assuming you qualify for the maximum possible Loan To Value (LTV) ratio, the breakdown is as follows:

- First 5% in cash

- Next 20% in any combination of cash or CPF

- Last 75% covered by the bank loan

This is based on your property price or valuation, whichever is lower (for new launches, only the sale price is used).

So for a condo priced at $2 million, you would pay a minimum of $100,000 in cash. The next $400,000 can be in any combination of cash or CPF, and the total loan quantum would be $1.5 million.

To avoid any shocks, I should state that – in practice – it’s common for buyers to pay more than the minimum down payment when buying an HDB property. This is because for HDB properties and ECs, CPF only allows you to keep up to $20,000 in your CPF OA, when making the down payment. Everything else must go into the down payment. There is no such restriction for private condos, however.

So in the above example, if your combined CPF with your spouse is $500,000, you must pay at least $480,000 for the downpayment, in addition to the minimum cash amount. You can’t deliberately choose to use only $400,000 from CPF, to get more financial leverage.

A side-note on the LTV

The LTV ratio can be reduced for a number of reasons. For example, if the loan tenure plus your current age exceeds the retirement age of 65, you could end up with an LTV as low as 45%. Banks can also reduce the LTV for other factors, such as the age of the property, or your credit score.

For the purposes of this article, we will assume you qualify for the full LTV without issues; but I will post a future article dealing with LTV-related problems, or rejected loan applications.

2. TDSR limits and monthly loan repayments

Under the Total Debt Servicing Ratio (TDSR), your maximum monthly loan repayment, plus other debt obligations, cannot exceed 55% of your combined monthly income.

Note that this is not the same as HDB’s Mortgage Servicing Ratio (MSR), as the MSR only cares about your home loan amount. TDSR also includes debts such as car loans, education loans, credit card loans, and so forth.

(For credit card or credit lines, the minimum required repayment is used to calculate TDSR)

For TDSR purposes, the bank will use a floor rate of 4% or 4.5% per annum, to estimate your monthly repayments. This is regardless of the actual rate you’re getting.

So in our above example, for a $2 million condo, we are looking at a maximum loan amount of $1.5 million. Assuming we use a 25-year loan tenure, at the floor rate of 4%, the monthly loan repayment would come to $7,918 per month.

(You can use this online calculator to get the rough figures.)

Assuming no other debts, this would require you to have a minimum, combined monthly income of around $14,397 per month.

But meeting the minimum is not the same as “safe”

If we want to follow the 3-3-5 rule, then assuming monthly payments of $7,918 per month, you would need a combined income of around $26,394 per month instead.

If this is too high, you will have to save up more, take a smaller loan (or extend the loan tenure), and reduce monthly repayments until it falls to 30% of your monthly income.

For example, let’s say you and your spouse have a combined income of $14,000 per month. To keep monthly loan repayments to 30%, you must only be paying $4,200 per month.

This would be possible if your total loan amount were reduced to $796,000 (at 4% per annum for 25 years) – but this means you must be able to pay around $1.2 million upfront.

This is why a well-planned property progression plan is so important: if your previous home has seen good appreciation, then the sale proceeds of your past home, plus accumulated savings, might suffice for a higher cash outlay (e.g., if you could sell your flat for $700,000, and have accumulated another $500,000 in your combined savings or CPF).

An important consideration for the self-employed, or those with alternative income sources

If you are self-employed, or you choose to include variable income sources like rental, the bank will count your earnings as being 30% lower (based on the amount shown in your IRAS tax form).

Which income streams can be used for TDSR varies from one bank to another. Some banks accept stock dividends or P2P lending revenue as income, for instance, whilst others may not.

3. Stamp duties

The Buyers Stamp Duty (BSD) is on a tiered system; but you don’t need to calculate this manually. You can use this page to get the figure, which for our $2 million property, comes to $69,600.

We will assume this is not a second property; but if it were, there would be 20% ABSD (an extra $400,000 for buyers who are Singapore Citizens).

One thing to note is that the stamp duties, unlike loans, are based on your property price or valuation, whichever is higher. So if you buy a resale property, and the seller wants a price that’s above valuation, you will end up paying higher stamp duties also.

4. Miscellaneous costs

These are the small costs such as conveyancing fees (usually around $2,500 to $3,000), relevant insurance premiums, mortgage document stamp fee or valuation costs (some banks make you pay for your own valuation, if you are buying a resale property).

There are also agent commissions, but this is rarely a cost to buyers. By convention, it is the seller who pays commissions for both their own agent as well as your buyer’s agent, unless some alternative agreement is reached.

I would place these miscellaneous costs at roughly $5,000.

There are also renovation costs, but it’s quite hard to give an estimate for this

Renovations are a matter of personal taste, and can vary hugely based on how much you want to indulge. I have seen renovation costs from as low as $20,000, all the way to over $100,000.

We’ll just estimate it at $30,000 for our example. This amount is also the maximum renovation loan from most banks, by the way (it’s usually six months of your income or $30,000, whichever is higher).

So how much is the “safe” amount to have?

Let’s summarise. For our $2 million condo unit which is probably a 2 or 3-bedder in today’s market, we will need:

- A combined income of $26,394 per month, to keep monthly loan repayments to 30% or under. Again, this is assuming a maximum loan at 25 years. As mentioned above, if your combined income is lower at $14,000 and to keep monthly loan repayments to 30% of this income, your loan would be $796,000.

- Around $699,600 for total initial cash outlay. This figure is derived from 30% of unit cost ($2 million) + stamp duties ($64,600) + misc. costs including renovation ($35,000).

- Minimum cash in hand of $100,000, and at least $400,000 in CPF; but ideally, we want $1.2 million in cash and CPF, to reduce monthly loan repayments to 30% of the combined income.

Practically speaking, the hurdle for most Singaporean buyers is not so much the TDSR. Rather, the main challenge to most buyers – particularly young buyers – is the minimum cash down.

For HDB upgraders, it’s important that you still have cash in hand after selling your flat. Otherwise, if you refund the full amount to CPF, you will probably struggle to cover the first 5% (in our example, $100,000, which is no small amount to most of us).

You’ll also notice that most restrictions – such as TDSR limits – can be gotten around, if you can afford a higher initial down payment. This again highlights the importance of careful property choices: for aspiring upgraders, it’s important that your previous home appreciates well, and allows you to bridge the gap to your next property.

I have used a $2 million unit in this example, because it’s a common price point for new launch, three-bedder units at present. For different price points, or unique cases, do reach out to me and I can help you plan the numbers accordingly.