As of June 2024, the entry price of an inter-terrace landed home is likely to see transaction prices of around $4 million, not to mention the substantially higher renovation costs that follow. This quantum may potentially be challenging for many Singaporeans, even with the sale proceeds of their previous home. One alternative option is to look at strata-titled landed properties: these are landed units that are part of a development (e.g., within a condo, or a cluster housing project). But this isn’t the same as owning a “pure” landed property, and some may find it worth buying more than others.

What are strata-titled landed properties?

Strata-titled landed properties (sometimes just called Strata Landed) are residential units that form a common development, with shared facilities.

Like a condo development, these projects have a Management Corporation Strata Title (MCST), to which members (the owners or subsidiary proprietors) collectively contribute to the maintenance of the development, obey the by-laws, have a management committee, etc.

Strata landed is often found in two forms:

The first is commonly called cluster housing. These are developments where every unit is a landed home. While terraced houses are the most common, some may also have detached houses, semi-detached houses, or even a mix of different housing types. Examples of these projects include Hillcrest Villa, The Woods and Cabana.

The second are landed units within a condo project. Most recently, for example, Parc Clematis and Normanton Park both had landed units, in addition to their usual condo units; as do many earlier projects such as D’Leedon and Kew Green.

Why buy strata-titled landed homes?

There are a few reasons why buyers may choose these, instead of “pure” landed properties:

- Lower quantum

- Access to shared facilities

- No need to maintain the exterior facade

- Buyers have no interest in A&A or extensive changes

- No concern over lease status

1. Lower quantum

One of the main reasons for strata landed homes is the overall quantum. In general, you will pay less for these units compared to a “pure” landed property.

For example, say you want to buy a landed home in a prestigious area, like District 10. One option is to buy a pure landed property; another may be to look at semi-detached cluster housing, such as Eleven @ Holland:

Admittedly there isn’t a high volume of transactions, but this can’t be helped as landed projects are usually small with fewer units, hence a more limited price history.

Landed home prices in District 10, as of 2023 3rd quarter, average $1,934 psf. A unit at Eleven @ Holland averages just $1,006 psf.

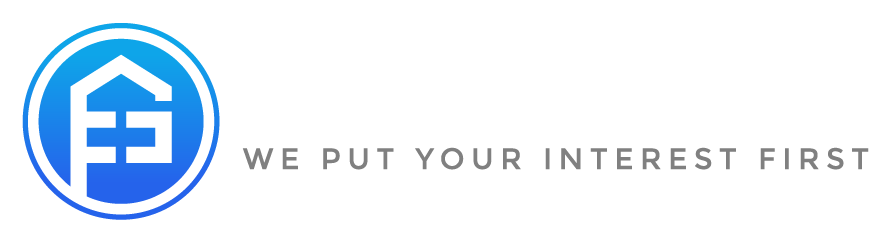

What about in a less central area? Well, check out The Shaughnessy, a cluster housing project in Yishun (District 27).

The Shaughnessy had no transactions in 2023 3rd quarter, but we can see that in 2nd quarter, its average price was as low as $688 psf. On the other hand, landed home prices in District 21 averaged $1,702 psf.

Given the lower price point, many strata-titled landed homes may still be within the $2 million to $3 million range. This is much more affordable, especially considering the higher home loan interest rates in 2023.

2. Access to shared facilities

Another reason to opt for strata-titled landed homes are the facilities. Just like a condo, these projects can have a pool, gym, and private security.

I should caution you, however, that most cluster housing projects have smaller facilities than a full-sized condo. This is for practical reasons such as land area, as well as maintenance costs (there are fewer units to share the costs, so having full condo-sized facilities may be prohibitively expensive). So I wouldn’t expect multiple pools or tennis courts; and where they appear, I would expect maintenance to be on the high side.

One way around this is to just buy a landed unit inside a condo, such as a villa at Normanton Park. This way you get full condo facilities while still having a landed unit.

3. No need to maintain exterior facade

If you own a true landed property, then all maintenance falls to you alone. One of the most expensive consequences of this is maintaining the exterior: this means patching the roof, repainting the external walls, clearing the drains, maintaining your garden and so forth.

If your property is strata-titled though, you don’t need to handle these on your own. It’s covered as part of your maintenance fee.

As a side-benefit, most strata-titled developments have private security. This greatly reduces the risk of vandalism. (While you may think vandalism is rare anyway, there have been cases where neighbours owed money to loan sharks, even in landed areas; and the neighbouring unit being splashed with paint can make yours look bad also).

4. Buyers have no interest in A&A or extensive changes

One of the main advantages of a true landed home is that you can change it however you want (within URA and SLA regulations). If you want to add a new floor or partly remodel the house (Additions and Alterations, or A&A), or even tear it down and build a new one, you’re free to do so.

This is not possible with strata-titled landed homes, as you still need to maintain some uniformity with the other units. The strictness of the rules varies with each project; but some are so regulated, you can’t even change window-grilles or paint the front gate a different colour (check with the management before you buy!)

If you have no interest in A&A or other custom work though, you might want to settle for a lower-cost strata-titled home. The ability to modify the house would be of no real advantage to you anyway. It will not increase the value of your house.

5. No concern over lease status

Most – but not all – strata-titled landed homes are 99-year leasehold. If you’re a firm believer in freehold or 999-year lease properties, you may find a wider range of options among pure landed properties.

On a related point, bear in mind that strata-titled homes can go en-bloc, if sufficient votes are garnered. Those who dislike this risk may prefer to have their own true landed properties.

Is it worth buying a strata-titled landed home?

If your goal involves rental yield, then strata-titled will almost always beat a true landed property. This is because with strata-titled being cheaper, it is more likely to see higher rental yields* from it than from a true landed home.

* rental yield is annual rental income / total property cost

But it is, at any rate, quite rare for buyers of landed homes to be interested in rental yields.

The main concern is likely to be capital appreciation – and this is where it gets sticky. Due to the lower transaction volumes, and the huge variations between landed units (both strata-titled and true landed), it’s not easy to make predictions.

But one of the things we can see is that leasehold landed tends not to appreciate as well as freehold landed.

To be clear, the above doesn’t distinguish between strata-titled and true landed (there’s no available data for this at this time); but it does have some relevance. We can, for instance, deduce that a leasehold-landed cluster housing might not appreciate as well as freehold or 999-year lease cluster housing. The same could apply for strata-titled homes within a 99-year leasehold condo.

Because this is so generalised, I would be wary of any predictions. We’d have to look closely at the specific property involved, before stronger conclusions can be drawn.

But for now, I would say that many strata-titled landed homes are better suited for own-stay use, rather than any financial aims. They’re affordable alternatives to true-landed homes, and allow for a landed-living experience with fewer maintenance hassles.

In fact, since 2021, our property prices have generally increased 20% to 30%. I have received more enquiries from home owners looking at the option of cluster housing as pure landed homes have become prohibitively expensive.

If you have a specific property in mind, reach out to me so I can help you with comparisons and a closer analysis.