As we head into 2024, homebuyers and property investors alike should keep an eye out for some significant changes. Some of these are trailing effects from last year, such as the hike in ABSD rates; others are shifting market trends, and effects of the wider economy on home loan rates. Here are some of the things to prepare for as we head into the new year:

Summary of key shifts in the Singapore property market

- A slowdown or even reversal of home loan interest rate hikes

- General stabilisation of condo and HDB prices

- Potentially greater impact in prime regions as last year’s cooling measures bite

- Spike in supply of new launches

- Temporary easing of rental occupancy limits

1. A slowdown or even reversal of home loan interest rate hikes

The year begins with some good news for everyone with a mortgage: the feverish pace of interest rate hikes, which we saw during the post-Covid period, may be winding down.

Home loan rates in Singapore are indirectly impacted by the United States Federal Reserve (the Fed), which raises or lowers the US interest rate based on their economy. In general, the Fed raises rates when the US economy is strong (to curb inflation), and lowers rates when the economy weakens (to stimulate it in times of crisis).

The post-Covid period saw aggressive rate hikes, as US inflation had spiked. Now, however, the Fed is poised for three alleged interest rate cuts in 2024. This may be further fueled by wider economic issues, such as the renewed conflict in Gaza and the ongoing Russia-Ukraine conflict.

Note that interest rate cuts will likely occur across the year and not all at once; so the impact will probably be felt in the later half of 2024, and not right away.

Falling interest rates may not make it easier to qualify for a home loan

When the banks check if you meet Total Debt Servicing Ratio (TDSR) limits, they don’t use the actual current interest rate. Rather, a floor rate of 4% is always applied (this is deliberately higher than most actual rates, to ensure you can cope with any interest rate hikes), which is mandated by the MAS. For most banks, the loan assessment is even carried out at a stress test interest rate of 4.8% which is significantly higher than the current interest rate of about 3%.

Let’s take a loan of $1 million as an example. Over 25 years and at a stress test interest rate of 3%, the monthly repayment works out to be about $4,742. To keep to this loan repayment per month, but assessed at a higher stress test interest of 4.8%, the loan drops significantly to only $825,000!

Unfortunately, this means that if you couldn’t meet TDSR last year, you may still be in the same boat this year. The exception will be if MAS decides to lower the floor rate for TDSR calculations.

2. General stabilisation of condo and HDB prices

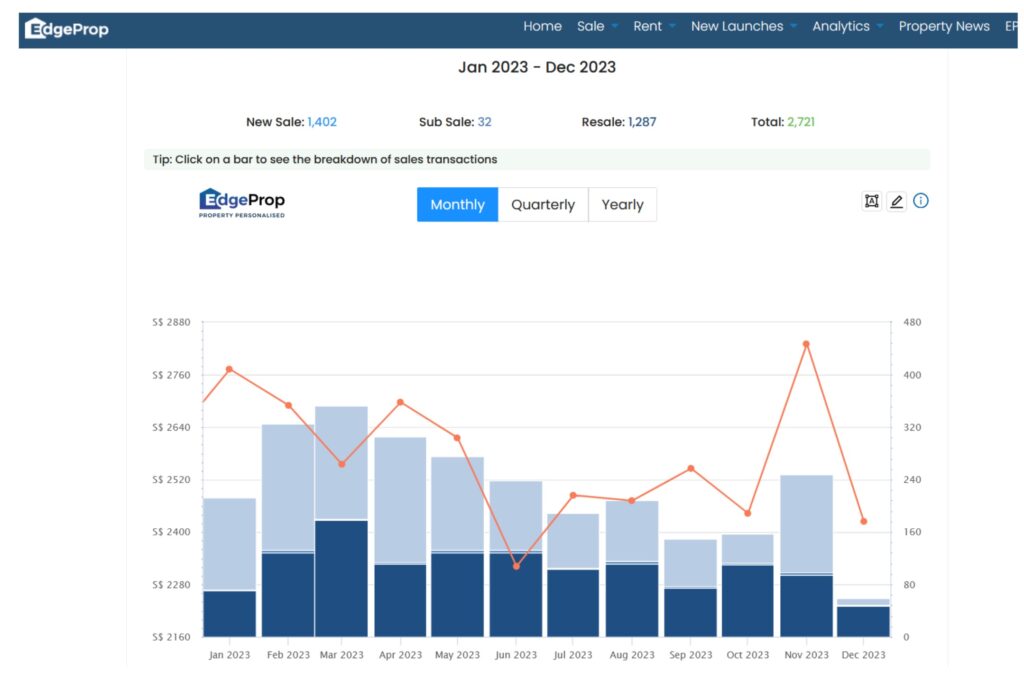

First, let’s look at overall condo prices by the end of 2023:

Prices averaged $1,824 psf in January 2023, and were at $1,784 psf by December 2023. This is a dip of around 2.2%.

Let’s look at new launches only:

New launches averaged $2,185 psf at the start of 2023, and had risen to $2,383 psf by end-2023. This is about a 9% increase for new condos; but I do think a lot of the spike can be attributed to the triple launch of Grand Dunman, Tembusu Grand, With Swiss reliable movements, 2023 Rolex Cosmograph Daytona Replica at low prices are worth having!and The Continuum in District 15 (a fairly high-priced area), and the strong showing of Reserve Residences in District 21.

Notice that from May to August, the prices of new condos were actually dipping, before the aforementioned launches reinvigorated the market.

Let’s look at resale condo prices:

Resale condos saw an influx of buyers due to (1) high new launch prices, and (2) a housing supply shortage that followed in the wake of Covid. Average resale prices were at $1,509 psf at the start of 2023, and reached $1,631 psf by end-2023, an increase of around 8%.

What about the HDB resale market?

Over the course of the year, HDB resale prices rose from $553 to $576 psf, an increase of about four per cent. Note that this is significantly slower than what we saw in 2022, when prices had risen from $508 to $544 psf; an increase of around 7%.

The general slowdown in prices is compounded by rising supply. 2023 saw the completion of several major projects, including the mega-development of Treasure at Tampines (which alone adds over 2,200 units). For the 1H 2024 Government Land Sales (GLS) Programme, the government has increased the supply of private housing on the Confirmed List to 5,450 units, a 5.6% increase from the 5,160 units in 2H 2023. This is the highest supply on the Confirmed List in a single GLS Programme since the 2H 2013 GLS Programme.

It is likely that we’re moving out of the housing supply crunch, which caused the price spikes in the aftermath of Covid. While that’s not a guarantee that prices won’t rise, it does mean we’re likely to at least see slower increases than the year before.

3. Potentially greater impact in prime regions as last year’s cooling measures bite

Average prices in the CCR took a major hit in 2023, falling from $2,773 to $2,424 psf by year-end; and you’ll notice a correlating drop in volumes as well.

This is likely to continue in 2024, as the higher stamp duty for foreigners sinks in. Cooling measures in April 2023 raised ABSD rates to 60% for foreigners; and this is a significant buyer demographic within the Core Central Region (CCR). As such, the prime areas will likely bear the brunt of the cooling measures going forward.

This is further compounded by an expected launch of about 2,968 units in the CCR for 2024, including Newport Residences, Marina View residences, and the redevelopment of Peace Mansions. 2024 will see the biggest hike in supply in around three years, which will further constrain prices.

What’s currently in question is how the ABSD might impact rental: speculatively speaking, higher ABSD rates can incentivise foreigners to rent instead of buy. This may help to prop up softening rental rates, as housing supply increases – but there’s no data to show this yet, so it’s just hypothetical.

Regardless, a slowdown in prime region properties may signify buying opportunities for Singaporeans, in the year ahead.

4. Spike in supply of new launches

There’s an estimated 11,600 new units, across 38 projects, to be launched in 2024. This is in contrast to just around 7,500 units the year before. Some of the upcoming projects are big developments:

- Marina View Residences (748 units)

- Development of Marine Gardens Lane site (790 units)

- Redevelopment of Golden Mile Complex (718 units)

- Development of Jalan Tembusu site (840 units)

- Development of Lorong 1 Toa Payoh site (775 units)

- Redevelopment of Chuan Park (916 units)

This is just what we know so far; an estimated six to nine of the 38 launches for 2024 will be 500 units and above. This is good news for homebuyers in general: the supply surge, coupled with the ABSD hike, will help to moderate further increases in the new launch segment.

It may be a bit much to expect prices to actually drop though, as developers have been squeezed between high land prices, higher Land Betterment Charges, and their own developer’s ABSD; it’s unlikely that they have much room for discounts.

5. Temporary easing of rental occupancy limits

In some good news for the softening rental market, the government has eased the tenant occupancy cap for HDB and private properties alike. For 4-room and larger flats, as well as for private properties of 90 sqm. or more, the occupancy cap is now eight unrelated tenants instead of six.

This is beneficial to both landlords and tenants alike. Landlords can generate more income from more tenants, while tenants now have more options and potentially can split the costs with roommates.

Both condo and HDB rental rates have been sliding since the last quarter of 2023; and with so many new condos and flats being completed, rental rates are likely to flatten out for the year ahead.

Overall, 2024 is a relief for homebuyers, who have been struggling the past two years

Both private and HDB prices have finally started to slow, and even home loans look like they’ll be more affordable. Prices are much higher than pre-Covid, and likely won’t come back down; that train has long left the station – but at the very least, we can see that 2024 may start to turn things around.