During the National Day Rally in 2023, it was announced that the old system of classifying HDB flats by mature and non-mature towns would be discarded. Instead, flats will now be stratified into Prime, Plus, and Standard.

(As a side-bonus, the end of “mature / non-mature” labelling means that single Singaporeans can now apply for new 2-room flats anywhere, whereas in the past they were restricted to non-mature estates).

The “Prime” flats refer to the Prime Location Housing (PLH) model flats, of which we already have some (Rochor was the first, after which Queenstown, Bukit Merah, and Kallang / Whampoa also saw PLH flats). Prime flats are located in more central regions, with quicker access to the city centre (areas like Orchard or the CBD).

Plus flats are a new concept, which will only appear in 2024. The HDB enclave at Bayshore is planned to be Plus category flats. Plus flats are closer to the hub of their specific neighbourhoods (e.g. closer to the mall or MRT station).

Standard flats are just the regular flats we have today.

Both Prime and Plus flats have the following added restrictions:

- 10-year Minimum Occupancy Period (the 10-year MOP will also apply to subsequent buyers in the resale market).

- Subsidy Recovery (SR), which is the clawback on subsidies when you sell the flat. This is due to subsidies for Prime and Plus flats being much higher than regular flats (more on this below).

- No full-flat rental, even after MOP. You can only rent out rooms, not the entire flat.

- Only for Singapore Citizens.

Note that other normal eligibility requirements, such as the income ceiling of $14,000 per month, the Mortgage Servicing Ratio (MSR) of 30%, and the ethnic quota still apply on top of these.

Are Prime and Plus flats viable, if you want to upgrade to a private property?

As Prime and Plus flats are so new (at the time of writing there hasn’t been a single Plus development yet), a degree of conjecture is unavoidable. There are no guarantees on the future resale demand for these flats. However, we can pinpoint a few negative factors for upgraders:

- A longer time to upgrade with Prime and Plus flats

- Uncertainty over future resale demand

- SR raises risk of negative cash sales

- Competition with flats that predate Prime and Plus categories

1. A longer time to upgrade with Prime and Plus flats

Remember that the MOP countdown begins when you collect your keys, not when you successfully ballot for your flat. Assuming a construction time of five years, a 10-year MOP would mean it’s 15-years before you’re able to resell the flat.

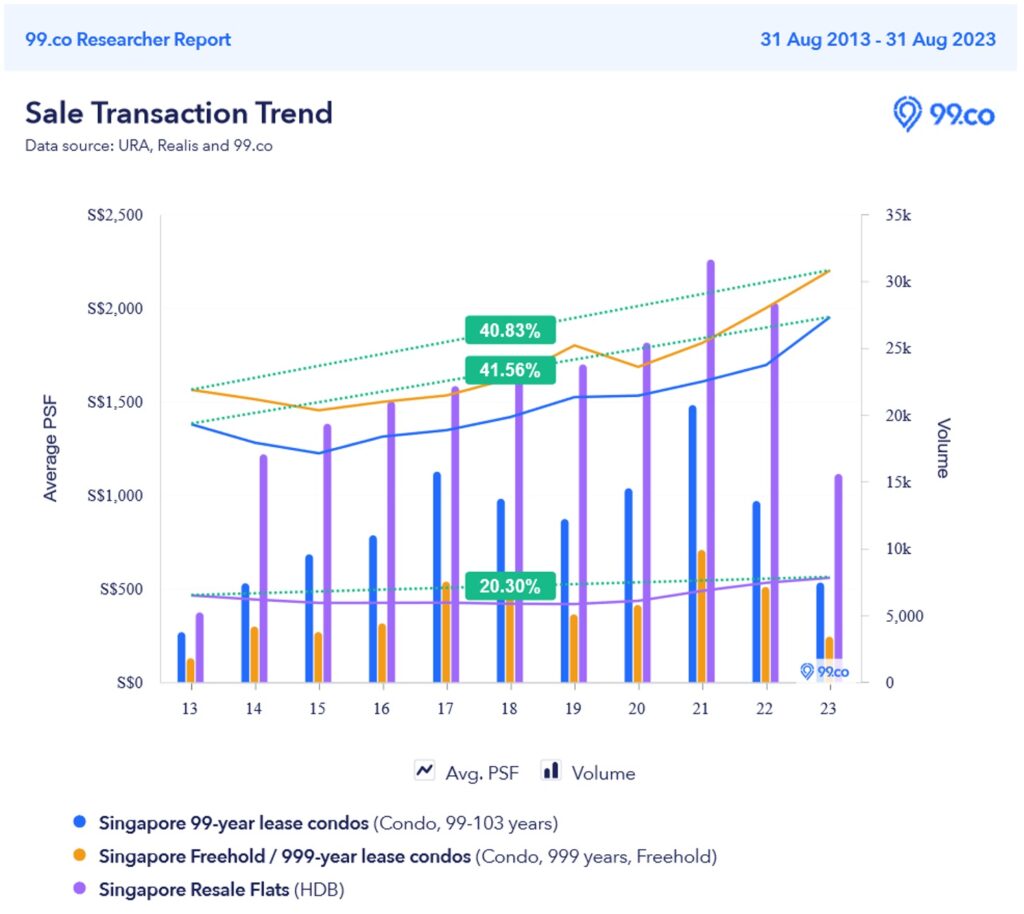

Of all the factors above, this may be the greatest disincentive for upgraders. Historically, private property prices have appreciated faster than HDB flat prices. Let’s look at the prices of condos, which are the most common types of property that HDB owners upgrade to:

Over a 10-year period from 2013 to 2023, the average prices of HDB flats have increased from $463 to $557 psf. This is a roughly 20% increase. Over the same time period however, leasehold condos have appreciated by around 41.5%, and freehold condos have appreciated by around 40.8%.

The price gap between HDB and leasehold condos used to be about 197.3%, back in 2013. Today, it has widened to around 249.9%.

On average, it is becoming more difficult to bridge the price gap between an HDB flat and a private property, as prices rise each year. What you see above is just over the past 10 years, so imagine how big the gap could be if you were to wait 15 years.

You also need to consider the impact of ageing

To secure full financing, your age plus the loan tenure cannot exceed the retirement age of 65. So if you’re 35 years old when you buy a Prime or Plus flat, you could be 50 years old before you’re in a position to sell.

This means your condo loan will have a maximum loan tenure of just 15 years if you want to secure full financing. This will significantly raise the monthly loan amount, or you may not be able to secure the same amount of financing as compared to when you were 5 years younger (assuming your income remains the same).

You also need to consider what your financial situation will be like at that point. Are you, for instance, comfortable with still paying a mortgage once you’re past the age of 55?

2. Uncertainty over future resale demand

Will future buyers be willing to accept a 10-year MOP, and a flat that they can never rent out in full, even after such a long time?

The only honest answer is: we don’t know.

Prime and Plus flats are totally new to the Singapore market. We have no history to check, and no precedent to go on. This makes their future resale demand a matter of pure speculation, and your guess is as good as any expert’s.

Given how long you’ll be saddled with this asset – around 15 years if you’re the first buyer – you need to consider if your risk appetite is really up to it.

Would a buyer be willing to be locked in for a period of 10 years?

3. SR raises risk of negative cash sales

The subsidies for Prime and Plus flats need to be much higher than normal; not least because potential buyers might bust the income ceiling and MSR limit, if the flats were at true market value (e.g. flats in Queenstown can reach the $1 million mark).

For the first batch of buyers, you need to pay back these big subsidies when you sell the flat. However, SR is not standardised – HDB will let you know the SR rate for the specific project before you buy.

The SR will be on top of refunding the CPF monies you used (with the accrued CPF interest rate currently at 2.5%), and discharging any outstanding home loan. If you add the SR on top of this, you might find yourself paying back so much money that you’re left with little or no cash in hand.

This is a problem because there’s a minimum cash down payment of 5%, on any private property; and this is before additional costs, like an asking price above the valuation and the stamp duty.

Due to the SR, anyone who wants to upgrade from a Prime or Plus flat needs to carefully track their CPF usage. Some may have to use partial cash payments for the home loan, just to ensure their CPF refund won’t leave them without cash later.

4. Competition with flats that predate Prime and Plus categories

Prime and Plus are not retroactively applied. This means that many existing flats which meet the category of being central, closer to MRT stations, etc. can rival Prime and Plus flats, but at the same, lack the restrictions imposed on them.

Consider The Pinnacle @ Duxton, for example, where a 4-room flat just sold for $1.37 million. The Pinnacle @ Duxton is not under the Prime or Plus category; it has a five-year MOP, it can be rented out in full, and there is no income ceiling.

When the time comes to sell your Prime or Plus flat, the future buyers will weigh up properties like The Pinnacle @ Duxton, or desirable flats in Bishan, Queenstown, Tanjong Pagar, etc., which are just as convenient as yours, but have much fewer restrictions. This can make for rather stiff competition, which adds to the risk I mentioned in point 2.

There is a gradual solution to this discrepancy, if we consider the prime-but-not-Prime flats are already very old; so perhaps their lease decay will balance them out against actual Prime / Plus flats. But again, this is in the realm of speculation.

The general conclusion points toward “no” for upgraders

There are too many variables and unknowns, to consider Prime and Plus flats a good stepping stone for property progression; and what is known is a drawback for upgraders (10-year MOP and SR).

Prime and Plus flats are better for own-stay use: they’re ideal for people who are dead certain they want to spend most, if not all, of their lives in a given location.

For those who want to upgrade to a private property, standard flats hold greater advantages. A standard BTO is the cheapest flat option (thus raising savings and lowering CPF usage), while a standard resale flat is the fastest upgrading option (there’s no construction time, so you know you’re okay to sell in five years).

Perhaps this opinion will change many years down the road, when the first Prime and Plus flats enter the resale market.

If you’re considering upgrading, but aren’t sure how to best proceed, you can reach out to me and I’ll help walk you through the process. For property, always get an expert opinion early, as a single conversation can save you many years of setbacks.