Boutique condo projects, which may have as little as 100 or fewer units, are challenging to value. The small unit count often means lower transaction volumes; and because newer boutique condos are often (but not always) aimed at a higher-end luxury crowd, they may be a pure consumerist move. That is, they’re purchased for pure home ownership reasons like high privacy, as opposed to investment returns. This makes it difficult to provide a simple yes-or-no answer, to the question of whether boutique condos are a good buy. Here are the main factors to beware of:

The distinguishing traits of boutique condo units

Although each project has some unique features, these are the main features you’ll find in most boutique condos:

- Small land size, resulting in more limited facilities

- Volatile price movements due to lower transaction volume

- Tend to be pricier as they’re freehold

- Higher degree of privacy

- Generally easier as an en-bloc prospect

- Built by smaller and less well-known developers

1. Small land size, resulting in more limited facilities

As an example of this, consider a luxury but boutique condo such as The Boutiq at Killiney Road (the developer even picked the name “Unique Development Pte Ltd” to reflect the unique nature of the project).

The Boutiq is in the highly prestigious Killiney area (River Valley), and one would assume such a condo has lavish facilities. However, the land size of this project is just 3,233 sqm (around 35,000 sq ft.), which doesn’t leave much room for common facilities; there is a basic lap pool, gym, sauna, and little else – not even a single tennis court.

there isn’t much space left for other facilities.

This isn’t to say The Boutiq is bad. It’s more that you accept fewer facilities, in return for a less-than 10-minute walk to the heart of Orchard Road. To some home buyers, this trade-off is more than worth it.

Another example would be Rezi 35, near Paya Lebar Quarter (PLQ). This entire project has only 44 units and is housed within a single tower, which is sandwiched on both sides by other projects. Like The Boutiq, the facilities are quite basic – a gym, a pool, and some limited BBQ space (but no tennis court). The trade-off here is that it is within seven minutes’ walk to PLQ, a major commercial hub with malls, Grade A office space, and restaurants.

The limited facilities are somewhat balanced out by the fewer units, as there are fewer people to share them. However, those who want grander facilities such as multiple pools and tennis courts, rock-climbing walls, several BBQ pavilions, etc. may not enjoy these smaller properties.

2. Volatile price movements due to transaction volume

I will cover this in greater detail below. But for now, here’s an example of what I mean.

This is the price history of The Asana, a 48-unit development in the prime Bukit Timah region:

After the initial developer sales, which ended in March 2018, there are only sales of single units throughout the years. This makes the price volatile, because the conditions of the last sale can greatly impact the perceived value.

For example, the last sale in July 2023 was at $2,612 psf. This was far higher than another sale in April of the same year, which was at $2,129 psf.

The April transaction is also much lower than a sale in July 2022, which was at $2,712 psf.

Now, what makes the April transaction price so low?

Unless we manage to find the actual realtor or seller, and get them to explain the reason, we’ll probably never know. It can be due to anything from poor maintenance, to someone selling to a relative (e.g., parents selling to their own children), to an urgent sale due to financial issues.

In a large condo project, where there’s a high volume of sales, these outliers can be spotted and ignored: we’d be able to determine the median price, and filter out any abnormally high and low transactions.

But in a boutique project, we don’t have that luxury. If the previous transaction was unusually high or low, it will give a distorted sense of the property value. This can translate to higher gains and higher losses for sellers.

3. Tend to be pricier as they’re freehold

Boutique condos tend to spring up in pricier freehold land plots (while the price per square foot is higher, the overall quantum is lower, and more affordable for smaller developers).

You may also notice that, in the examples I’ve given so far, many of the Boutique condos like The Boutiq or The Asana, are in prestigious locations like Bukti Timah, River Valley, and so forth.

Boutique condos are quite frankly targeted at more affluent buyers, who are willing to pay for the prime location and greater privacy. As such, these condos are rarely a budget option.

There’s also the likelihood that maintenance costs are higher, as there are fewer owners to contribute to the maintenance fund. A 400-unit condo, for instance, is essentially splitting maintenance fees among 400 homes, whereas a 16-unit boutique condo only has those 16 households to bear the entire cost.

This is sometimes counterbalanced by the fewer facilities, which mitigates some of the cost.

4. Higher degree of privacy

The advantage of having fewer units is that there’s no noise or crowds (unless you’re unlucky and get a bad neighbour!). The gyms and pools will be less crowded, and there are no long waits for the elevator.

If you don’t like the ruckus of large developments, a boutique condo may be preferable for you.

5. Generally easier as an en-bloc prospect

When developers take on a collective sale, it’s at substantial risk to them.

Developers only have five years to complete and sell off all the condo units, lest they end up paying Additional Buyers Stamp Duty (ABSD) of 40%.

Developers can claim ABSD remission of 35%, only if they meet the five-year time limit.

The twist here is that the government doesn’t care how big the condo project is. Whether a developer is trying to build 1,000 units, or just 30 units, the same five-year time limit still applies.

Coupled with the lower overall costs (because the land parcel is smaller), this means boutique projects are less risky to developers.

For buyers, this raises the possibility of a successful en-bloc sale a few years down the road. Also keep in mind that many boutique condos are on freehold land (see above), which means developers don’t have to pay to top-up the lease. This makes them even more enticing targets for collective sales.

6. Built by smaller and less well-known developers

When looking up the developers of boutique condos, you may not see names that you recognise. This is because most of the larger developers (CapitaLand, Far East Organization, Hoi Hup and Sunway, etc.) have little interest in boutique condos.

(Even if the risk is lower, there’s frankly not much profit in selling such a small volume of units).

Developers in the boutique condo market tend to be smaller, or may even be entirely new names. These are developers who don’t have the deep pockets to bid for Government Land Sales (GLS) sites, or to launch en-bloc attempts for the big (800+ unit) condo projects.

That said, note that some developers – such as Aurum Land – are known to specialize in high-end boutique condos.

Investment wise, is it worth buying a boutique condo unit?

Because boutique condo units have such volatile prices, it is difficult to answer this question. A good analogy will be the tortoise and the hare:

A large condo development can be likened to the tortoise, which shows a consistent but probably slower pace of appreciation. A boutique condo is more like the hare, which may either (1) stand still and do nothing, or (2) make sudden large leaps forward.

As I’ve mentioned above, boutique condo prices can be greatly skewed by the transaction just before yours: if someone sold their unit for a much higher price, the perceived value can rub off on your unit, and vice versa if they sold for too low.

Measuring boutique condo prices against their district average

Note: Due to the very nature of boutique condos, which have few transactions and don’t compare well to larger condos, the following is a rough picture only. The intent is to show you, in a general sense, how much the performance of these projects can diverge from district norms.

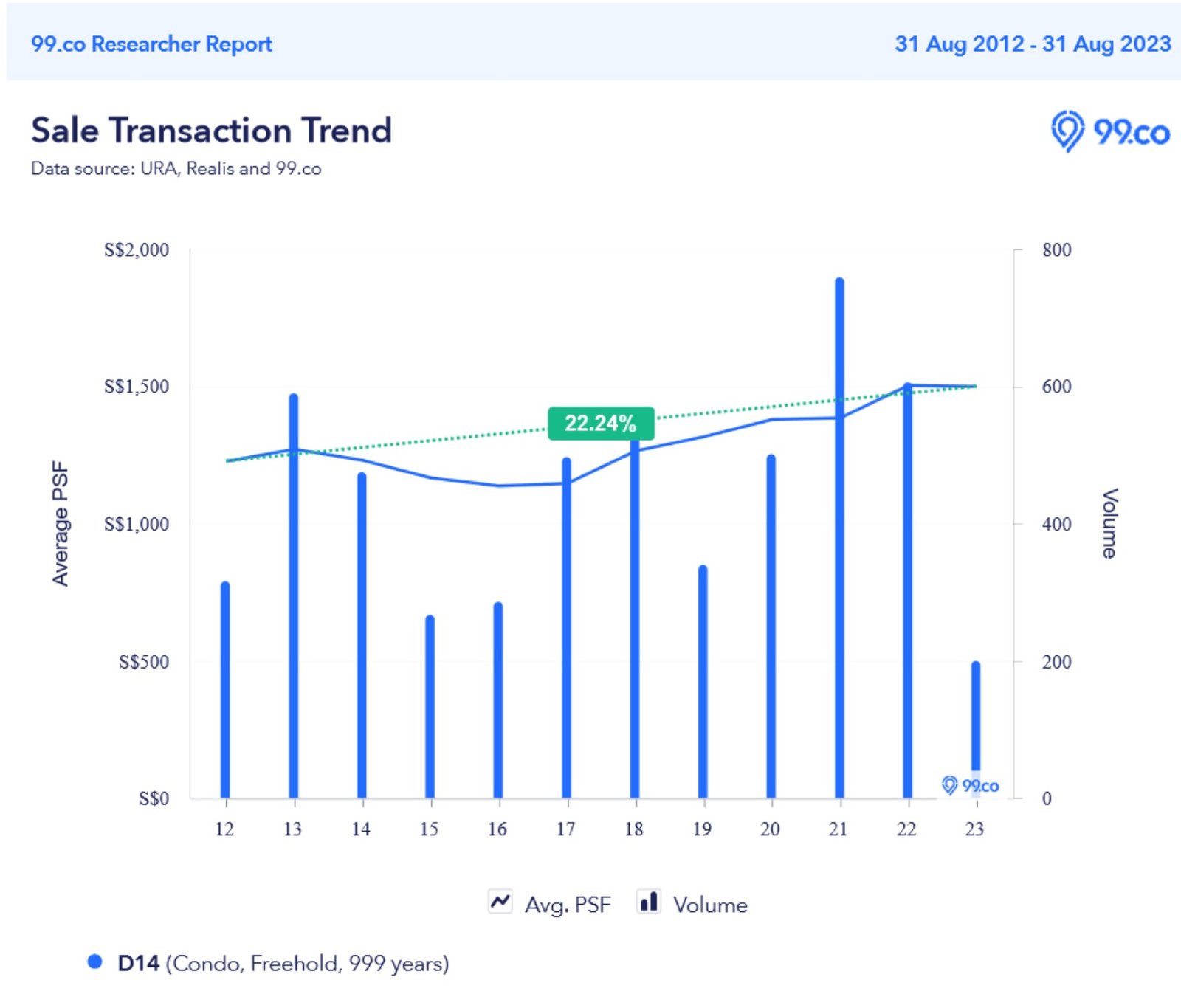

Despite the low transaction volume, we can try to weigh up a boutique condo’s price movements against the district average. This might give a sense of how well they’re faring.

Silverscape is a 45-unit condo, located within district 14. It was completed in 2015, and is – as we might expect – a freehold project.

Looking at Square Foot Research, we see prices jumped from $1,231 psf in 2012, to $1,540 psf in 2023; a roughly 11-year period.

This is a 25.1% increase over 10 years, or a compounded annual growth rate of about 2.05%.

Looking at 99.co, I checked price movements for other freehold and 999-year condos in the district. We can see the price movement for these properties rose between $1,226 in 2012, to $1,499 in 2023.

This is a roughly 22% increase over the same 11-year period, or a compounded annual growth rate of 1.8%.

In this instance, average prices in Silverscape appear to be outpacing the district average.

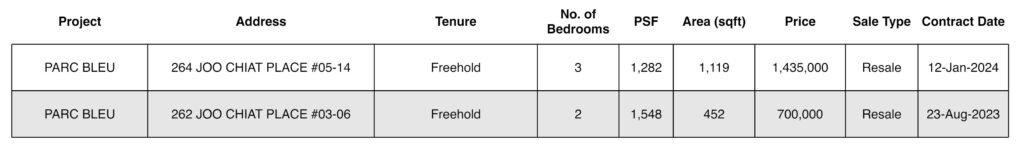

Conversely, let’s look at Parc Bleu, in neighbouring District 15. This is again, a freehold project with 55 units. As you’d expect by now, the price movement jumps around quite a bit:

Prices averaged $1,264 psf in 2012, and reached $1,521 psf in 2023. This is a 20.3% increase, with a compounded annual growth rate of 1.69%.

Looking at 99.co, and again keeping to freehold / 999-year lease condos, we can see the district 15 average rose from $1,344 psf in 2012, to $2,204 psf in 2023:

This is an increase of around 63.9% over the same time period, or a compound annual growth rate of 3.79%.

Here, Parc Bleu appears to have significantly underperformed against the district average.

What’s more surprising is, just looking at the price trend, we noticed a sharp plunge in price from $1,548 psf in Aug 2023 to $1,282 psf in Jan 2024!

On closer examination, we realized the sharp plunge was caused by the big difference in size of the transacted properties. My point is, unless the buyers have access to the tools and information to dig deeper, otherwise the price appears really volatile.

You are less likely to see such wild swing in prices in large developments as there are more transaction volume to smoothen out the volatility.

Boutique condo units are best purchased for owner-occupancy reasons

Because their resale potential is so volatile, there’s no precise way to gauge how much of a return to expect. A boutique condo is equally capable of both greatly outperforming and underperforming its surrounding properties.

It’s best if you purchase these properties for genuine home ownership reasons, such as if you enjoy the peace and quiet, or if the location matters more to you than overly-lavish facilities.

If you want to focus on gains, the best we can do is examine the specific unit in question. Send me the details, and we can do a walkthrough of the unit and the neighbouring properties. Even then, it’s hard to promise certainty with these units.