Prices of new launches have been shooting up over the past three years, and this has led to many people asking a common question: Why does anyone still buy a new launch condo? If the price is so high, then there must be no room for much appreciation, correct? The answer to this lies in developer pricing strategies, and the buyers’ willingness to bet on this for future gains: due to the manner in which new launch condos are priced, which is, if all things go well, it’s possible to realise gains much sooner than at the point of resale. You’ll be told this sales pitch when you visit a show flat as well, so let’s clarify the details:

Let’s look at some new launches in the past, and see if you can spot the pattern in their price movement

For the following, we are looking solely at developer pricing:

Treasure at Tampines is the biggest condo project to date in Singapore, with 2,203 units. During the earliest sales in March 2019, median prices were at $1,335 psf. By the time the last few developer sales were concluded, in February 2022, median prices were at $1,584 psf.

Leedon Green is a high-end development in district 10, and freehold to boot. This 638 unit condo started off with median developer prices of $2,782 psf, back in January 2020. By the time developer sales ended around October 2023, the median price had risen to $3,137 psf.

Stirling Residences is another mega development with 1,259 units, and it was quite popular due to the Queenstown location. When sales began in July 2018, median developer prices were just $1,746 psf. By June, we see a median price of $2,621 psf.

The general trend is that prices tend to be lower for “early bird” buyers, which provides room for appreciation

With Leedon Green, for instance, some buyers questioned if $2,782 psf – high for 2020 – could still see appreciation. But in around three years, the median price had risen to $3,137 psf. Assuming a buyer bought early and could sell their unit for this amount, they would have recognised a roughly 12.7% gain in just three years!

This is why some buyers are still confident opting for new launches in 2024. While the prices have hit new heights (the “norm” is now around $2,200 psf even at launch), they are hopeful – or confident – that developer prices will still rise. In this sense, they would have made their returns by the time the condo reaches Temporary Occupancy Permit (TOP).

However, this is not risk free, as there is a chance that developers may lower prices after launch. It’s uncommon, but it does happen – I will cover more on this below.

One manifestation of this is subsale opportunities

While I would never advise someone to gamble on subsale opportunities arising, these can and do happen. This is when someone purchases the condo unit from you before the project even reaches TOP. As the price would have risen by then, this could result in realising a profit before you even see the condo built.

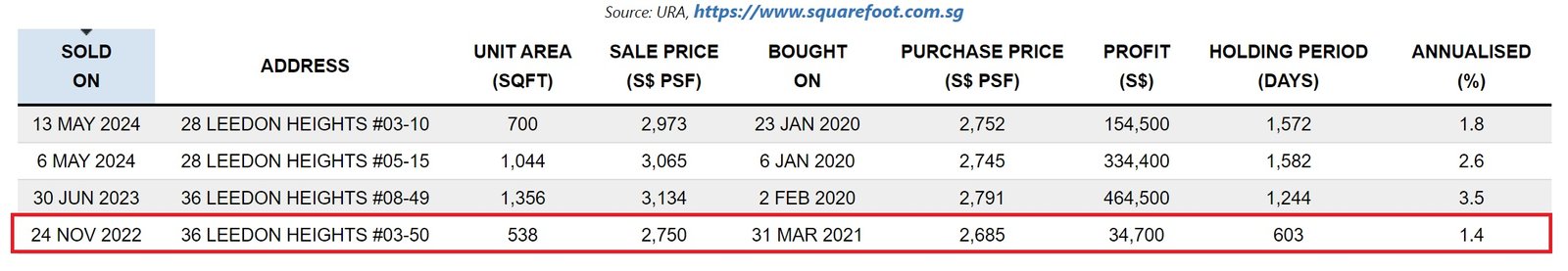

For example, looking at transaction records, we can see that on 24th November 2022, a unit was sold at Leedon Green (before Leedon Green’s TOP in 2023). This was for a one-bedder unit bought at $2,685 psf, but sold at $2,750 psf.

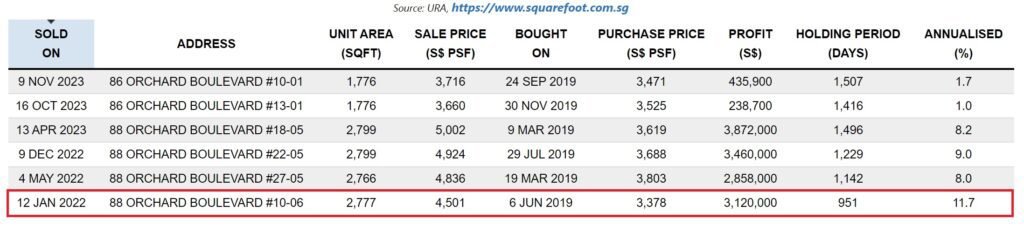

Sometimes the subsale amounts can get very impressive. Boulevard 88, a small luxury condo in Orchard, was briefly quite famous for this. On 12th January 2022, a 2,777 sq.ft. unit here was sold for $4,501 psf, when the original purchase price was $3,378 psf. This resulted in profit of over $3.1 million, even before the condo was completed.

This being said, subsales are not something you can reliably count on. It may also be meaningless to a home buyer who genuinely needs the property to live in; you probably don’t want to wait another three to four years for your home, even if you have a chance at a subsale.

The other big reason why subsales are difficult is because your unit is no different from a developer’s unit, and a developer can pay high commission (up to 8%) to property agents to bring buyers. But as a resale seller, most are only willing to pay up to 2% of the property price as commission. With lower monetary incentives, property agents will likely bring the buyer to buy from developer rather than your subsale unit.

By the way, do note that subsales can trigger the Sellers Stamp Duty (SSD), which is imposed if you sell a property within three years of acquiring it (this is 12% on the first year, 8% on the second year, and 4% on the third year). Most subsales occur in the fourth year for this reason.

Besides being cheaper at the start, developers push out lower quantum units first

Developers love to tell the news that they “sold out” on the launch weekend, or that they moved a huge percentage of units. To make this happen, they may launch only a select number of units first (especially if the project is quite large).

They also tend to make the smallest units, the one and two-bedders, the most attractively priced at this stage. From a developer’s perspective, this is a clear win for them: these units push up the overall price psf*, while the quick sales help to create a sense of popularity and urgency.

For new investors looking for lower-quantum units, this may be an ideal time to dive in. After all, the earlier you buy, the bigger the discount you may be getting. However, buyers may find that certain blocks or layouts are still unavailable at the earliest launch phases (if the developer has a premium block with better views, they may keep that for later, being confident they can sell it even at a higher price).

*The smaller the unit, the higher the price $psf tends to be. A shoebox unit might be $3,000 psf whereas a three-bedder may be $2,100 psf; but if you consider that the shoebox unit is only 500 sq. ft., its total price is just $1.5 million, which is much more affordable to many buyers.

In later launch phases, or after TOP, developers may turn to other pricing strategies

The worst of these, which all early buyers dread, is the developer lowering the prices further. This can happen for a number of reasons; but the most common is the developer being unable to move larger, higher-quantum units.

A developer has to complete and sell out all its units – even the expensive penthouse ones – within five years, lest it suffers high ABSD penalties.

This was recently addressed in Budget 2024: developers were chafing so badly under the five-year ABSD deadline, that the government has now relented slightly; they only need to complete the project and sell out 90% of their units, and their ABSD remission is still possible (although varied according to the number of outstanding units).

Nonetheless, developers are always conscious of this deadline; and we can sometimes see prices dip in later sales, as they try to move remaining units.

At Liv @ MB, a 298-unit project at Marine Parade that’s still under construction, we’ve seen median developer prices dipping. Median price was at $2,405 psf in May 2022, but was at $2,206 as of October 2023.

(Please don’t take this to mean LIV @ MB is a bad project by the way; this has no bearing on quality. It’s just a matter of market movements and the developer’s circumstances.)

While early buyers could lose out in these scenarios, they also present an opportunity for later buyers. If you’re looking for a larger or high-quantum unit, for example, it might sometimes do to visit projects that are in their later launch phases, or which are dangerously close to their ABSD deadline. You may find that prices of specifically high-quantum layouts, such as premium four or five-bedders, or penthouses, might be going for a little less. This was what happened during the 38 Jervois fire sale, for instance.

As a final consideration, there is the Deferred Payment Scheme (DPS), which has been making a reappearance of late.

The DPS is only available after a condo has received its TOP. This is not really a “sales promotion,” but a way to structure the loan. Under the DPS, you may be able to put down 20% of the price and move into the unit right away (you may even be able to rent it out fully, depending on the contract terms).

You then have 24 months before you need to pay the remainder. To some extent this can save on interest, and it can help if you need time to secure a good loan.

But most commonly, using the DPS can often mean sacrificing your future gains. Developers will sell units at their absolute peak prices after TOP, and they may even add a premium on top of that if you use DPS.

So this scheme is only beneficial in highly niche situations, such as for seasoned landlords who are certain the early rental income (without loan repayments for two years) are advantageous enough to offset the higher prices.

Besides these, developers do sometimes have “flash” or short-term promotions, where they may sell all units between a certain number of floors at the same price, or discount a specific layout. These may not be publicly announced by the developer, so one advantage of having a good realtor is that we can keep an eye out for these, and inform you as soon as possible. Do reach out to me if you have questions about any new launches!