Some Singaporeans have very clear ideas on their property wealth journey. They’ve often planned out how they’re going to sell their flat and upgrade to a condo, or how they’ll subsequently upgrade from a condo to a landed home, etc. But one of the most common queries involves the step at the very beginning: if you’re planning to upgrade, should you buy a pricey resale flat? Or wait longer for a BTO flat?

The main considerations of BTO vs. resale flats for upgraders:

- Length of time to upgrade

- Cash Over Valuation

- Financial situation

- Renovation and furnishing costs

- Maturity of surrounding neighbourhood

1. Length of time to upgrade

For standard flats, there is a Minimum Occupancy Period (MOP) of five years. For Plus and Prime flats, the MOP is 10 years. It’s important to remember the MOP countdown begins after you collect the keys, and not from time of application, successful balloting, etc.

So if you were to ballot for a standard BTO flat, which takes four years to build, you would wait a total of nine years (4 years construction + 5 years MOP) before you can upgrade.

Buying a resale flat is, in this sense, a shortcut. There’s no construction time, so the MOP starts as soon as you move in. This is relevant to upgraders for three reasons:

The first is just your own lifestyle preference. You may feel that nine years of your life (or even more, for Plus and Prime flats) is too long, and you want to enjoy better facilities or an improved location sooner.

The second reason is ease of financing. As you get older, getting financing for a home loan can become tougher. As of 2023, to secure full financing, your loan tenure plus your age must not exceed the retirement age of 65.

What this means is that if you wait till you are 50 to upgrade, you can only have a 15-year loan tenure for your mortgage, if you want full financing (75% of the property price or value, whichever is higher).

If you exceed this limit, the maximum financing falls to 55% of the property price or value (whichever is higher).

This can result in the proverbial “between a rock and a hard place” situation, as you’re forced to choose between a higher down payment, or higher monthly loan repayments. So while it’s not impossible to upgrade later in life, it is ideal to try and do it earlier.

The third reason is the widening price gap between HDB and private property prices.

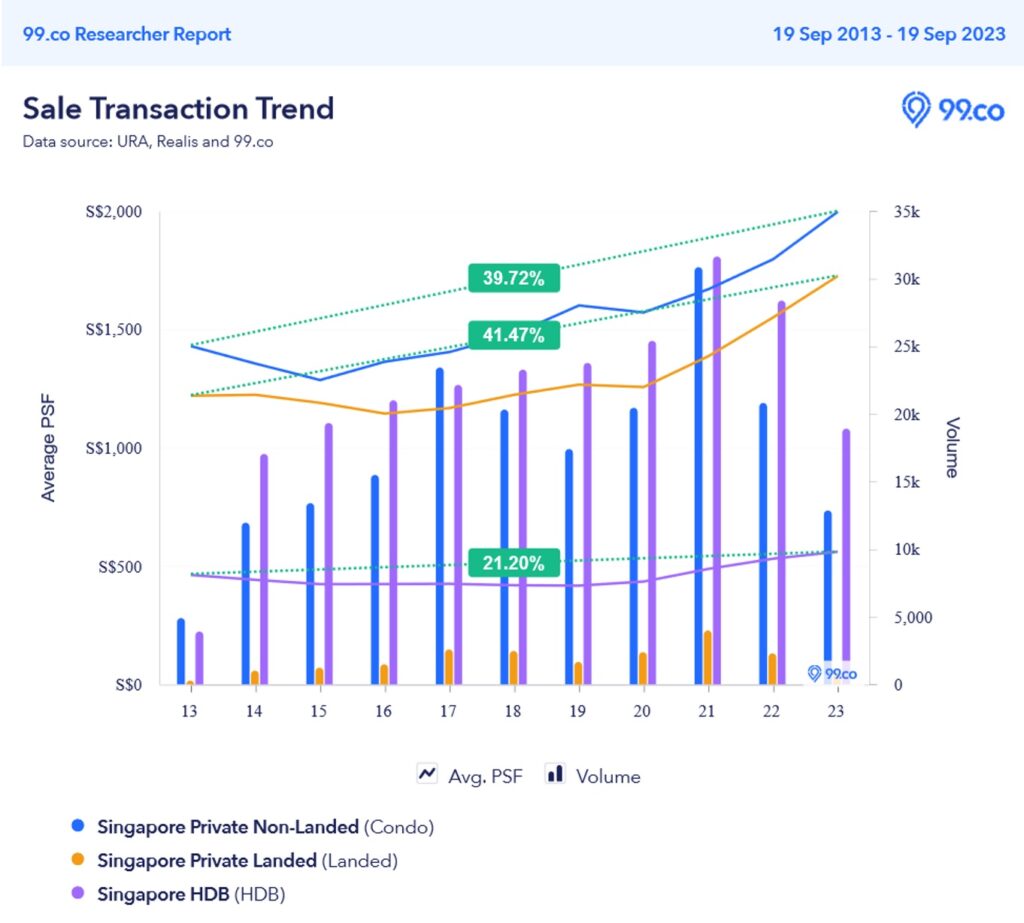

On average, most private home prices appreciate faster than flat prices. I’m aware that resale flat prices have been at all-time highs as of 2023, but let’s take a longer 10-year view:

You can see that compared to private landed and non-landed properties, resale flats tend to appreciate at a much slower pace. This means that every year you wait, you risk the price gap getting wider; and the sale proceeds from your flat may not cover the amount needed to upgrade.

2. Cash Over Valuation (COV)

Resale flats are pricier than BTO flats, and one of the reasons is COV. This is the amount above the value of the flat that must be paid in cash. E.g. if you agree to a price of $500,000 for a resale flat, but HDB’s valuation is just $$480,000, then the COV is $20,000.

COV must be paid in cash; it is never covered by the home loan (remember: the maximum loan amount is based on the lower of the selling price or valuation.)

HDB has stopped publishing COV rates since 2013, to discourage high flat prices. There’s no reliable way to check the likely COV you’ll pay on publicly available sources. But if you consult a realtor who recently transacted in the area, they often have a good sense of it.

You’ll need to consider if the higher price, and the drawback of paying cash for the COV, makes up for the shorter time period in which you can sell (see point 1).

3. Financial situation

Having established that it’s ideal to upgrade sooner rather than later, we need to acknowledge the reality of our financial situation. The fact is, just because we can upgrade in five years doesn’t always mean we should.

There’s no point rushing to upgrade in five years, only to find you’re struggling to afford the property, and having to sell and downgrade again. This can be an even worse setback, compared to just waiting and saving a few more years.

A common guideline you may have heard of is the 3-3-5 rule: the property should take up no more than 30% of your monthly income, you should have 30% of the capital needed, and the total price shouldn’t exceed five times your annual salary. You can read more about the 3-3-5 rule here.

This is quite generalised though, so I would speak to a financial professional for more thorough guidance.

In any case, if you find you can’t safely buy a private property in five years, it could make sense to buy a BTO flat instead. This could grant you a few additional years to save up, whilst also costing less (which also gives you a head start on savings).

4. Renovation and furnishing costs

If your plan is to upgrade in five years, you’ll want to spend as little as possible on renovation and furnishing. There’s no point blowing $100,000+ on renovating a unit that you’ll be selling so soon.

Unfortunately, this is where resale flats may present a downside. Depending on the age and condition of the flat, a resale unit may cost a lot more to renovate than a BTO flat. At the very least, you may have to pay extra for hacking costs, to tear down the former renovations.

There’s no way of telling how much the renovations would cost, as it varies based on your design and the contractor or interior designer; but if it ends up being $50,000+, you need to consider if this is affecting your ability to upgrade later. Bear in mind that renovation cost is a sunk cost. You may not be able to sell your flat at a much higher price to the next buyer just because your flat is renovated. On the other hand, it may be an issue for the next buyer when they see a higher asking price for a renovated flat or be left in a dilemma on whether they should keep or hack away your renovation which may not suit their tastes.

BTO flats, on the other hand, come in “ready to move in” condition from HDB. I have encountered families who have spent as little as $20,000 or less to renovate their BTO flat, in a very comfortable way.

5. Maturity of surrounding neighbourhood

HDB has done away with the mature / non-mature estate system, but this doesn’t change the reality on the ground. A flat located in the heart of Queenstown is still going to be more desirable than one in Tengah, Sengkang, or Punggol.

This is where resale flats might provide an edge for upgraders. Older resale flats can be found in more mature areas, where there are more malls, MRT stations, coffee shops, reputable schools and so forth. This could mean a quicker and easier sale five years down the road, or a more profitable one.

Conversely, a BTO flat in an unproven location – where amenities are limited (at least at the start) – may not fetch a sufficiently higher price later. You’d be making a potentially risky assumption that, in the years between construction and MOP, the neighbourhood will see substantial upgrades.

For BTO flats, foresight, opportunity, and chance play a bigger role. Punggol, for instance, might see benefits within such a time period due to the upcoming Punggol Digital District. If there’s a BTO launch near the planned area, I’m sure buyers would make a beeline for it; but such opportunities aren’t always available. You also need to be up-to-date and informed on these developments.

With resale flats, we already know the high-demand areas (e.g. Bishan, Queenstown, Toa Payoh). And while resale flats here are costlier, there’s a long transaction history to support their value. You also know there’s a large pool of willing buyers, due to the neighbourhoods being so well developed.

To give a general answer, resale is often – but not always – preferred by focused upgraders.

For many upgraders, the emphasis is to upgrade early; so many tend toward resale rather than BTO flats. Some of these buyers are very conservative, and may even opt for smaller and cheaper 3-room resale flats. They rationalise that, even if it’s uncomfortable, they only need to bear with it for five years.

But just because that’s the majority opinion doesn’t make it right for everyone.

Upgraders with lower income or in higher-risk jobs (e.g. they are self-employed and have variable income) may need to wait longer to upgrade anyway. If you feel it’s going to take you 10+ years to save enough for a condo, then it sometimes makes sense to opt for a cheaper BTO unit.

If you’re not sure which is right for you, reach out to me so I can help you do a walkthrough of your situation. A quick consultation could end up saving you several years of waiting in these cases.