The trend today is for larger condo units, able to fit families. This is partly due to the nature of buyer demographics: most home buyers in the private market are upgrading from HDB flats. Furthermore, learning from the lessons of the Circuit Breaker during the pandemic, some home owners are more cognizant of buying a bigger house in case another Circuit Breaker happens again and we are forced to live, eat, sleep and work from home. And yet, we constantly see that one and two-bedders sell out the quickest at launch. This is quite a paradox, and if you intend to buy a smaller unit, it’s useful to grasp what’s going on:

Important concepts in the market for small units

- Size may not match the description for older condos

- Higher price per square foot

- Expectation of higher gross rental yield

- Generally the first to move for new launches

- Can be tougher for resale prospects

1. Size may not match the description for older condos

By today’s standards, a one-bedder is usually 550 sq. ft. or below, while a two-bedder is usually around 700 sq. ft. If you need a quick mental comparison, a 3-room HDB flat is about 645 to 740 sq. ft.

For older condos, the description of a one-bedder or two-bedder can be way off from this. I recall a prime area condo (Yong An Park) where some of the so-called one-bedders were in excess of 900 sq. ft.

Resale condos, especially those from the ‘80s and ‘90s, were often built much bigger. So the concept of a one-bedder then, for example, doesn’t match the idea or quantum of a shoebox-type unit today.

2. Higher price per square foot

For smaller units, the quantum (overall price) is lower, but the price per square foot ($psf) is higher. When The M condo was launched in the Bugis area a few years back, for example, some of the one-bedders were priced as high as $3,000 psf. But due to the small unit sizes, the quantum was under $1 million.

So if you’re looking at overall affordability, it’s best to look at the quantum and not just the price $psf for these smaller units.

3. Expectation of higher gross rental yield

A lower quantum translates to a higher gross yield, as the formula for yield is (total annual rental income / total price of property) x 100.

So the lower the property price, the easier it is to get a high rental yield. For a typical family-sized unit, gross yields tend to be about 3%. For a one or two-bedder, we tend to expect a much higher performance; something to the tune of 4% to 5%.

This is a good indicator to watch for, if you plan on buying over a resale one or two-bedder for rental gains.

4. Generally the first to move for new launches

At new launches, a common tactic is for the sales team to tell you units are running out, people have already put down cheques, etc. Most of the time, you should be sceptical about this; there’s a tendency to exaggerate how fast units are selling, to create a sense of urgency.

It is, however, something more likely to be true for one and two-bedders. These are the fastest unit types to sell in most new launches, as they have a low quantum and are more affordable.répliques de montres,best replica watches,Fake Watches.

5. Can be tougher for resale prospects

It’s a bit harder to find buyers for small units, especially one-bedders, as the pool of potential buyers is smaller. Most people who upgrade from HDB flats, for instance, are families who need at least 900+ sq. ft. It’s quite hard to convince them to buy even a two-bedder, especially if they have multiple children.

This does not necessarily mean smaller units are less profitable; but it may mean you have to wait a little longer, to find buyers accepting of your resale price.

Considering the traits above, who still buys one or two-bedders today?

For the most part, these would be:

- New investors, and those with a “sell one, buy two” strategy

- Those who favour rental over resale gains

- Young professionals seeking quicker upgrading

- Lifelong singles

- More affluent retirees

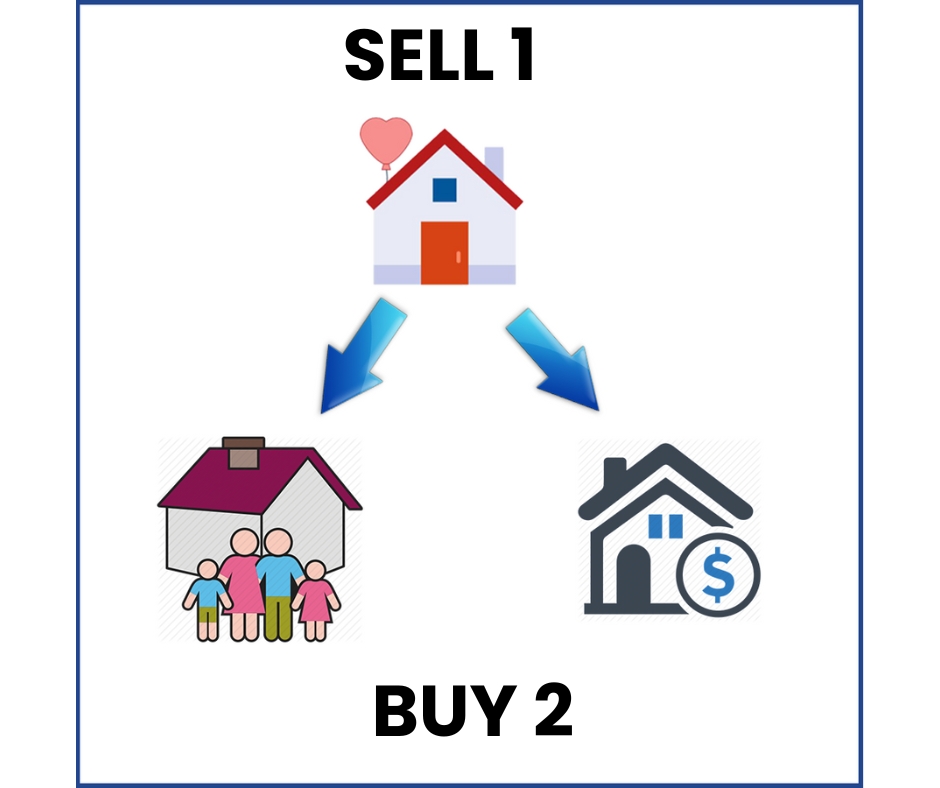

1. New investors, and those with a “sell one, buy two” strategy

Smaller units represent a more controlled risk, and an entry point for new investors without large amounts of capital. If you’ve heard of the “sell one, buy two” strategy, the second unit bought is quite often a one or two-bedder.

(Under this strategy, the current home is sold, and the couple each take on a different home under their own name, thus avoiding ABSD. One is a larger home, and the other is a smaller unit to rent out).

One thing to note though, is that investors pursuing this strategy inordinately favour new launches, where they can buy one or two-bedders with early-bird discounts. But some can be persuaded otherwise, if you point out that a resale unit can be immediately rented out, or if the unit can be bought with an existing tenant.

For those who must pay the ABSD, the lower quantum on small units means you’re also paying less ABSD.

2. Those who favour rental over resale gains

Smaller units excel for rental, due to the higher yields as described above. For resale, also as mentioned above, the prospective pool is smaller.

As such, it’s best to get a smaller unit if your goal is just to collect rental income, for years and years to come; or if your financial goals are highly specific (e.g., you must have an asset providing $X a month for your retirement target). In these instances, you don’t need to worry so much about the resale prospects.

If you hold on to a small unit and keep it rented out for decades, you would, at any rate, probably more than make up for any price dips upon resale.

3. Young professionals seeking quicker upgrading

There are some people who manage to do well right out the gate, and may have higher incomes as early as their 20s or 30s. If so, a one or two-bedder condo unit may be in reach.

These buyers may want to purchase a private property, which can be sold at any time* as there’s no Minimum Occupancy Period (MOP) like a flat. This allows them to move more quickly up the property ladder.

Some of these younger, high-earning professionals may even still live with parents. If so, they can derive rental income from the unit, eventually selling it to buy a bigger place of their own. As rental income can easily cover the mortgage interest and maintenance fees, they would essentially be “borrowing for free” for an appreciating asset.

*There is a Sellers Stamp Duty (SSD) that applies, if you sell within the first three-years of purchase; this is 12% on the first year, 8% on the second year, and 4% on the third year. But this still lets you sell penalty-free, one year earlier than the MOP; and unlike the MOP, you can always bite the bullet and sell anyway if you like. There have even been cases where an eager buyer ups the price, to cover the SSD.

4. Lifelong singles

There are couples who, for various reasons, will not get married or have children. For these groups, it may be unnecessary to get a home as large as a three-bedder.

A one or two-bedder could thus be an affordable home, with facilities like a gym, pool, etc. that they can’t get in an HDB project. On top of that, the small square footage means they will probably pay the lowest maintenance fees in the condo.

(The Share Value, which determined maintenance fees, are usually the same for both one and two-bedders, as the size difference is usually too slight to matter).

For these buyers however, I would be cautious about older resale condos. While the older condos may seem to have more space, they may also have inefficient features like long corridors, or big air-con ledges and balconies, that end up translating to less spaciousness.

Newer one and two-bedders tend to be much more optimised. TMW Maxwell, for instance, is a new launch at Tras Street. This project has 474 sq. ft. Flip / Switch units, which has movable storage features and in-built furniture (e.g., table that can fold or extend out from the wall).

For genuine home-owners, it’s more important to look for liveable space, rather than just raw square footage.

5. More affluent retirees

There are more retirees who, instead of right-sizing to a smaller flat, choose a one-bedder or two-bedder condo unit instead. I have met some who already plan to right-size from a 1,200+ sq. ft., condo unit, to a two-bedder once their children move out.

Recent policies somewhat contribute to this, as you need to wait 15 months to buy a subsidised resale flat, after selling a private property. But really, the main purpose is that a condo with common facilities can help in intangible ways.

For example, the children or other family may still visit for BBQs or to use the pool, creating a subtle reason to maintain contact.

If you meet any of the above profiles, it can be worth considering a one or two-bedder unit. But as always, you need to be picky in which projects you choose. For more direct help, contact me and I can help you do a walk-through, to see if the one or two-bedder you’re eyeing really suits you.