Many home buyers are confused by home loans. Apart from being more complex than the loans they’re used to, most of us will only have to “compare home loans” once or twice in our lives (and the rules are always changing!) It’s especially tough for HDB upgraders, because bank loans can be much more unpredictable; not to mention the banks themselves are more unforgiving than HDB. So to make sure you’re ready, here are some of the myths you should be aware of:

Myth 1: Banks are happier if you pay off your home loan faster

This is where banks and HDB are totally different. HDB’s objective is to provide affordable housing, so they are happy when you can pay off your loan faster – HDB loans will never penalise you if you decide to pay more for a few months, or even to fully pay off the remaining loan in one lump sum.

Banks, on the other hand, are usually not happy to have you pay off the whole loan at once. Banks make money from the interest rate on your home loan – and if you pay off that home loan all at once, it deprives them of the interest earned.

So, unlike HDB, banks always penalise you for trying to repay your loan early. For example: say your home loan has a lock-in clause of three years, and a loan tenure of 24 years. During the lock-in period, you decide to sell the property and discharge the loan.

In most cases, banks will charge you 1.5% of the amount you’re trying to pay off early. So if you attempt to pay off $1 million all in one go, you will end up with a penalty of $15,000. You can think of this amount as compensating the bank for the interest that they lose earning from you when you fully settle the home loan.

Those who don’t understand this may make the serious mistake of having multiple early prepayments. E.g., you make three early prepayments of $20,000 because you think you’re prudently accelerating home loan repayment – but that just results in $900 worth of pointless fees.

So remember that, unlike HDB, the bank may not be happy to just let you pay more back, as and when you want to. You need to check the terms and conditions: some loans let you make early prepayments after the lock-in period, and some let you avoid prepayment penalties only if you’re selling your house. Some prepayment penalties have a “cap”, such as applying a 1.5% only on the first $100,000 you prepay, and not on any amount beyond that.

If there’s a chance you may sell your home early, or try to discharge your loan before the loan tenure is up, look for these allowances.

Myth 2: The bank picks the law firm for you to use

If you really want to, you can turn down the law firm picked by the bank. You can opt to use a law firm of your choice instead, provided the firm is on the bank’s panel of approved lawyers.

This matters because not all law firms charge the same amount. A small firm specialising in just conveyancing law may charge only $2,500. A big, prestigious firm may charge $4,500. This is money out of your pocket – and given that the differences are minimal, prudent buyers will insist on the lowest-cost option.

As an aside, if you allow a bank to choose the law firm, the bank may choose a firm that only they recognise. This becomes a disincentive for you to refinance, if cheaper loans become available – because to refinance and switch to another bank, you need to pay the fees for a new law firm to take over.

Myth 3: The Loan To Value (LTV) ratio, as long as you don’t cross age limits, is 75%

As many realtors will tell you, the maximum loan amount is 75% of the property price or value, so long as the loan tenure plus your age does not exceed 65 (and you have no other outstanding home loans).

However, just because you meet that criteria, does not mean the bank is obliged to give you a property loan that is 75% of the purchase price. Banks can lower the LTV based on the nature of the property itself. One notorious example of this is Geylang: if your property is too close to the vice areas, banks may lower the LTV, or even deny you the loan altogether.

Another example is age and lease decay. The Hillford, for example, is a condo that only has a 60-year lease (it was intended to be a retirement project). The Hillford’s lease began in 2013, so there are only 50 years left. For those who stay for another decade or two, resale becomes risky, as the bank may lower the LTV once the lease is down to 30 or 40 years (subsequent buyers may have an LTV as low as 55%).

It’s not only your age and credit score, but also the age and location of your property, that impacts your loan.

Myth 4: Former bankrupts cannot get home loans in Singapore

This is a partial truth. Bankrupts cannot get home loans; but if you were formerly bankrupt (i.e., you have received your official Letter of Discharge from bankruptcy), it’s possible to get a home loan again if you wait a while.

For most local banks, you may have to wait five years after the official discharge before you can get a loan; but foreign banks may be a bit stricter, and have you wait up to seven years. Admittedly this can be just as harsh, as you may then be too old to qualify for a long-enough loan tenure; but it is possible, so it’s wrong to say former bankrupts “cannot” get home loans.

As an aside, some non-banking Financial Institutions are willing to extend home loans as soon as you’re discharged from bankruptcy; but this is a tough decision, as you will usually face much higher interest rates compared to a bank.

Myth 5: It’s better to stick with the same bank

There is an issue that’s often confused with bonus saving tiers. This is when the bank raises your deposit interest rate, for performing certain activities. E.g.: if you credit your monthly salary to the bank, they raise your savings rate by 0.5%. If you spend $500 a month using one of the bank’s credit cards, they raise your savings rate by 0.5%, and so forth.

Sometimes, banks will raise your savings rate if you also get your home loan from them – this will be outlined in the terms and conditions of the savings account. You may, for instance, get a 0.5% increase in your deposit rates if you use a loan package from the same bank.

But one problem is that, like credit card promotions, these bonus tiers change all the time. Also, it’s possible that the extra savings are offset by the bank having higher interest rates anyway.

So to be clear, there’s rarely any “loyalty bonus” from sticking with the same bank. Quite often, it might mean nothing beyond paying more.

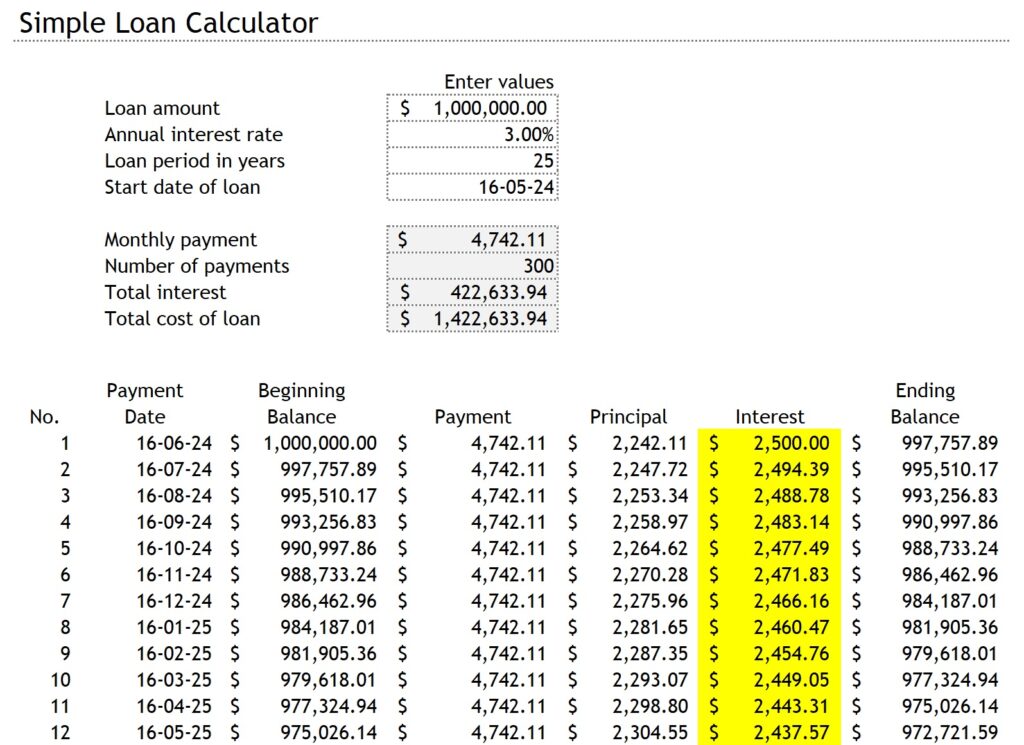

In fact, loyalty counts for nothing in the eyes of the banks. If you stay with your financing bank for a few years, they would rather you leave and bring in a new borrower. They won’t give you better service or lower interest rates as an incentive for you being loyal. On the contrary, your interest rate is the cheapest in the 1st year but most expensive from the 3rd year onwards. Why? Simply because banks earn the most interest from a borrower at the start of the loan. With each passing year, as the outstanding loan amount gets reduced, more of your repayment goes towards paying your principal and less towards interest (which is the bank’s revenue). So the banks are earning less and less from a borrower with each passing year. This is the reason why refinancing to another bank is so prevalent. For the borrower, it means a chance to get a cheaper loan. For the banks, it means a chance to get in a new borrower to earn the maximum interest possible.

Myth 6: The lowest interest rate is always the best option

There are two problems with this:

First, bank interest rates are not static. For most loan packages, the first three years are “teaser rates”, while the fourth year onward is the actual rate. For example, you may see an advertised rate like:

Year 1: 3M SORA + 0.4%

Year 2: 3M SORA + 0.4%

Year 3: 3M SORA + 0.4%

Year 4 and thereafter: 3M SORA + 1%

(3M Sora refers to the three-month SORA rate. You can check SORA rates on the MAS website. Note that because SORA rates change all the time, it’s not possible to predict an exact amount at the end of the loan tenure).

Consider the above, compared to a package from another bank that looks like this:

Year 1: 3M SORA + 0.6%

Year 2: 3M SORA + 0.6%

Year 3: 3M SORA + 0.6%

Year 4 and thereafter: 3M SORA + 0.8%

The initial years with this second package may be a bit pricier; but from the 4th year through to the end of the loan package, it may be cheaper. As such, the cheapest rate may not remain that way in the long run.

The second problem is that, if you look solely at the interest rate, you may be ignoring other key factors. For example, consider if you’re offered an LTV of 75% by two different banks, and you’re buying a $1.8 million resale condo*.

Bank A has a lower interest rate, but accepts a valuation of $1.7 million for the condo. This means your maximum loan quantum from them is $1.275 million.

Bank B has a higher interest rate, but accepts a valuation of $1.8 million for the condo. This is a loan quantum of $1.35 million.

This means you pay less cash upfront with Bank B, as bank loans cannot cover any cash amount over the valuation. This is why some borrowers may opt to tolerate a slightly higher interest rate, to pay a bit less upfront.

As an aside, acceptance of a higher valuation helps to support other factors later: a higher valuation can establish a higher base price at resale, or allow for larger loans if you use services like cash-out refinancing.

*Valuation is not a factor for new launch condos, as the developer’s price is taken to be the same as the value.

Myth 7: You need to refinance to get lower rates later on

There is another easier alternative to refinancing; and it can sometimes even be free. If you switch to a different loan from the same bank, this will be repricing and not refinancing. The cost can be a lot lower (e.g., under $1,000), in comparison to potential conveyancing fees for refinancing ($2,500 to $3,000).

On top of this, repricing may not require you to pay for a new valuation of your property, and you might keep certain benefits – such as bonus savings tiers – from the same bank. For some loans, the terms and conditions may even allow you to reprice for free (check before you take the loan).

Repricing doesn’t always work as a solution, as there’s no guarantee the same bank may have cheaper loan packages in future; but you may want to keep this option open, just in case it’s a possibility.

Bank loans can get confusing, and the constantly changing rates can cause quite a bit of anxiety. Those used to HDB loans may feel lost when it comes to bank rates – but do reach out for help, if you need advice or clarification.