Some people believe landlords have it made. They “shake their leg and drink coffee,” and rent money comes in every month. I wouldn’t say it’s entirely untrue, as some landlords manage to pull it off. But in reality, being a landlord in the current decade is much tougher than it was in the 1980s or ‘90s; and it requires a lot more hands-on effort and knowledge than before. Let’s sort through the truths, lies, and half-truths of what it means to be a landlord today:

Myth 1: Being a landlord means passive income

This is a bit of a half-truth, as property management can be quite hands-on.

If you take on all the tasks of being a landlord, such as finding your own tenants, it’s practically a full-time job.

The biggest property portals (I won’t mention any company names here) usually require you to be a licensed agent to list on them. So if you’re not an agent, you can’t advertise on the biggest property portals. That means you need to do a lot of legwork: asking around at universities, looking for potential expat tenants, and so forth.

Even after you find prospective tenants, you have to conduct viewings. Unless you drive, it’s quite challenging to rush to and from different places to handle the viewings. Then you need to do appropriate background checks, complete the Tenancy Agreement (TA), go through the inventory etc.

Of course you can skip this part by getting a property agent; but that still doesn’t mean the income is 100% passive. Technically the property agent’s job ends at finding the tenants, and later issues like maintenance still fall to you.

(I say technically because some agents are nice to enough to help with later issues; but not all of them will)

If the air-con breaks down, or the lights aren’t working, or the stove breaks, the tenant expects you to fix all this. I also know of landlords dealing with unusual situations, such as:

- The tenant and a condo security guard got into a fight, and the condo guard contacted a lawyer to sue the tenant. Also, the tenant was a student, and risked being expelled (which would have caused her to break the lease).

- A tenant passed away while residing in the condo, and the landlord had to deal with issues such as the deceased’s belongings, which had to be returned to the family.

- The tenants had agreed to split the power bill equally, but one tenant decided to mine cryptocurrencies, and drove the power bill up to a four-digit figure. The other tenants refused to pay their share as this was unfair, and the landlord had to mediate.

The truth is, as a landlord, there will be periodic emergencies and messy situations. So it’s not entirely right to call rental income “pure” passive income. On occasion, it can disrupt your other work, and take up a lot of your time.

Myth 2: Rental means you have money in your pocket every month

I would call this semi-true, but some people have the wrong idea about this.

Some people mistakenly define all rental assets as cash-flow positive properties. These are properties where, even after paying all recurring costs (bank mortgage, maintenance fees, power bills, property tax, etc.) the landlord still has money going into their pocket.

This is possible, but it’s not true of every rental asset. It usually happens only when the rental property has been paid in full (no more mortgage), or in very selected few properties (e.g., very old properties near the end of their lease, which have very low initial costs or are even bought without a loan).

If you’re still paying the monthly mortgage for the property, it’s unlikely that your rental asset is cash-flow positive. For example:

Say you have a property loan of $1.5 million, for 25 years, at a typical interest rate of 3%. Your monthly loan repayment in this case would be about $7,113.

To estimate the rent, you can simply use an estimated rental yield approach. If you were to take a back-of-the-envelope method to do some simple calculations, you would find that the property is highly unlikely to be cash-flow positive. Using the above example, if your loan is $1.5 million, your property value is likely to be around $2 million, assuming you take the full loan at 75% of the property value. At a rental yield of 3.5%, it is about $5,833 per month, still lower than the monthly loan repayment of $7,113.

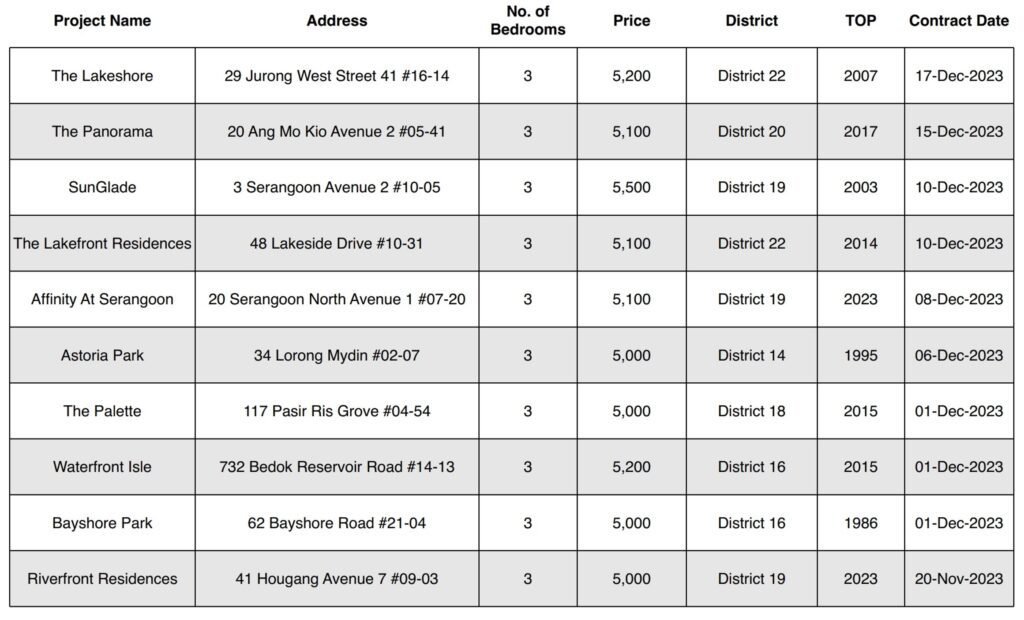

As of 2024, most almost brand new three-bedder condos (approximately 1000 sq. ft.) in the OCR region are fetching around $5,000 to $5,500 per month in rent. Although rental income is sufficient to cover the interest portion of the loan, as well as costs like maintenance fees; you’re still paying your property loan out of your wallet. There is no passive income.

This can still make sense as, when rental covers maintenance and interest, you’re essentially “borrowing for free” to own an appreciating asset. This is one of the main principles in using property assets to create wealth.

But if you insist on finding a property that’s cash-flow positive right away, do reach out to me and I’ll see what I can do for you. Such properties sometimes exist, but they’re not viable for everyone.

Myth 3: Landlords can only do well if they cater to families

In practice, I find unrelated (individual) tenants to be no worse – but also no better – than family units.

One of the overlooked issues here is that, when a family decides to break the lease or be delinquent in payments, you can lose the entire rental income at once. With unrelated tenants, even if one of them is delinquent or breaks the lease, you still have other tenants to collect rent from. At least the rental income will not crash to zero altogether.

Another common prejudice is toward student tenants. Maybe the perception is that they are unable to afford an expensive property or may not be able to make regular rent payments as they have no income. But in reality, I have come across student tenants who are just as reliable as families or working expats.

Foreign students in Singapore tend to come from wealthier families, as it’s not cheap to study here. Their parents will not allow their children to end up homeless on the street. And it is the parents, not the student tenants, who pay the rent. They are very reliable as it affects the roof over their son or daughter’s head.

Also note that, if you want to cater to families, that means having to buy at least a three-bedder. That’s a bigger risk as it’s a higher commitment of capital, and the higher cost translates to a lower rental yield:

(Annual rental income / Total property cost) x 100% = Gross rental yield

By simple maths, you can see that a cheaper one-bedder or two-bedder is going to end up with a higher gross yield.

Myth 4: You need to be ultra-rich first to become a landlord

It’s the other way around.

In most property success stories, the tycoons become landlords first, and get rich from doing it. They didn’t wait to get rich first, before starting to invest in properties.

You don’t need to be a multi-millionaire buying whole condo blocks, to start being a landlord. Many new investors start from renting out the humble HDB room and, with savings and planning, move on to rental assets like resale one-bedders. From there they progress to two-bedders, to family units, and so forth.

There are even landlords who upgrade from an HDB flat to a dual-key property. This lets them live in a sub-unit of the property while renting out the other half, and they don’t even pay ABSD for a second property. New projects like Lentor Hills Residences, Grand Dunman and The LakeGarden Residences all have layouts like these.

As realtors, it’s part of our job to help you get started, even from the ground up. From there it’s a matter of patience, and carefully progressing through the right properties.

That said, I have to admit it’s easier to start being a landlord if you’re already rich.(But everything in life is easier to start with if you’re already rich)

Myth 5: Being a landlord is more trouble than it’s worth

This could be true for some people. It depends on your personal inclinations.

First off, I should point out that it’s possible to hire a property manager to handle your rental assets. In fact for landlords with larger property portfolios, it’s almost inevitable that they’ll do this, as it’s tough to manage more than one or two properties personally.

Second, there are some ways to minimise the effort involved. For example, some landlords rent the property to companies, who set up co-living spaces and sublet them. The landlords only collect rent from the main company, while the co-living companies handle the separate rents of their sub-tenants.

Third, some landlords rent out “bare bones” units, described as unfurnished or semi-furnished. This lets long-term tenants customise the interior a bit more; and it saves you the trouble of lengthy inventor-list inspections.

But all this aside, there are some people for whom being a landlord is never right. If you prefer assets that don’t need you to interact with any tenants, or assets with a faster rate of return (e.g., high octane stock trading), then there may be no way to convince you it’s worth the effort.

Myth 6: All the higher taxes placed on landlords will eat up all the profit

It’s true that landlords pay higher property taxes than owner-occupiers. You can compare the two here. Note that property taxes have increased as of 2024.

However, landlords in Singapore get more tax deductibles than you might suspect. One example of this is the home loan interest rate. Have you ever wondered why, with home loan rates climbing in 2023, so many property investors seemed unfazed and continued buying?

One simple reason is that, as landlords, the interest rate portion of the mortgage is tax-deductible. In fact, quite a few costs are tax-deductible, such as:

- Your property agent’s commission for the first and subsequent tenants, if you used one to find said tenants

- Maintenance costs such as pest control, electrical rewiring, etc. (but not your renovations!)

- Any fees paid to property management companies

- If your tenant isn’t paying for internet access or utilities, you can claim them as tax deductions too

There’s more and you can see the whole list here.

Coupled with the lack of capital gains tax and inheritance tax, rental income does make up for a lot of the costs, even if they’re higher compared to those for owner-occupants. replica omega,replica watches,rolex replica.

Myth 7: Being a landlord makes you evil

Let’s not forget that Singapore’s rental market deals primarily with foreigners, not local Singaporeans who deserve a home.

Close to 90% of Singaporeans own their own home, and are not at the mercy of any landlord. It’s a minority of Singaporeans who rent, and most only do so for short periods, such as while waiting for their new flat or condo to be built.

You should also consider the good you can do as a landlord. If you’re more about contributing to society than about money, your rental asset can be a way to give back. It’s within your prerogative, for instance, to offer lower rents to people who are fleeing from dysfunctional families; or to be more accepting of minority demographics or the elderly when accepting tenants.

So being a landlord doesn’t necessarily transform you into an evil oppressor. Owning a rental asset can be a way to do good, beyond the financial concerns.

Whether or not you should be a landlord depends on your finances, as well as your personal inclinations. I’d be the first to say it’s not the right role for every investor. But don’t allow over-generalisations like the above to get in your way; let me know your main worries, and we can work out whether being a landlord suits your needs.