After you have shortlisted some properties to buy, the next step is to make comparisons. This is both an art and a science. The truth is, no comparison can be 100% fair and exact – even if they’re next to each other, two properties will differ in age, facilities, maintenance, number of units, layout, size and so forth. This means that the best we can do is try to make as fair a comparison as possible; and some elements may not be visible on paper. This can lead to a lot of mistakes, and I have tried to list down some of the following which are most common:

Mistake #1: Not comparing between the same floors

Here’s a real example I came across recently: a buyer wanted to buy a one-bedder condo near Tanah Merah MRT station, as it’s got a direct line to Changi Airport; this was important as he worked for an airline.

However, the newest condo at Tanah Merah (Sceneca Residences) was deemed to exceed his budget, so he instead considered two nearby alternatives: Grandeur Park and Urban Vista. These are both resale condos. When he initially asked to look at numbers, he was shown the following transaction figures:

Grandeur Park

| Transaction Date | Unit Size | Price PSF | Total Price |

| 20 Sep 2023 | 549 sq. ft. | $1,931 | $1.06 m |

Urban Vista

| Transaction Date | Unit Size | Price PSF | Total Price |

| 13 Apr 2023 | 592 sq. ft. | $1,584 | $938,000 |

These transactions are verifiable, and you can check them for free (along with other transactions) on the URA transaction database. So we know caveats were lodged for these two deals, and they’re real.

This comparison checks the right boxes in several areas: they both occurred within the past 12 months, and the unit sizes are very close. Based on these two, the buyer was easily led to conclude that Urban Vista is much better value. The unit is both bigger and cheaper.

But what has been omitted here? Upon closer inspection, the Grandeur Park address was “11 Bedok South Avenue 3, #14-53”. It’s on the 14th floor.

But the Urban Vista address was “18 Tanah Merah Kechil Link, #03-38.” This is a unit that’s on the third floor.

Lower floor units are usually priced lower than high-floor units; so this is the real reason that the Urban Vista unit was both bigger and cheaper. But just by omitting this detail, the buyer was led into believing that Urban Vista is a better value buy.

We need to be careful of this sort of cherry-picking; and when we make comparisons, we should be wary when the unit floor is not revealed to us.

Mistake #2: Trying to make comparisons for boutique / low transaction volume projects

When it comes to boutique projects, such as those with 50 units or below, comparing price history can be almost useless. This is because the volume of sales is extremely low, and any single outlier will skew the average price. Here’s an example:

This is the price movement of Botanika, a luxury boutique condo, taken from Square Foot Research. There are only 34 units. You can see that across its history, whole years can go by with just one or zero transactions. This causes the price to spike or fall erratically, as the very last transaction will skew the price average. So if the most recent transaction was an outlier (e.g., an owner in dire financial straits had to fire-sale the property), this could cause a serious downswing in average price.

In some parts of Singapore, notably Joo Chiat, Telok Kurau and the East Coast area, there can be large numbers of boutique condos. For these properties, the price history is so volatile that it’s of little value in comparisons. These projects require us to go down to fundamentals: visiting the property, checking the condition, looking at the distance to amenities, etc.

The viewing will determine the decision, not the prices on paper.

Mistake #3: Not checking the sale dates when comparing performance

Consider Midtown Residences (not to be confused with the newer Midtown Bay or Midtown Modern!), which has a total of 38 profitable transactions, and 21 unprofitable transactions. If we look at its price movement on Square Foot, words like “mediocre” come to mind:

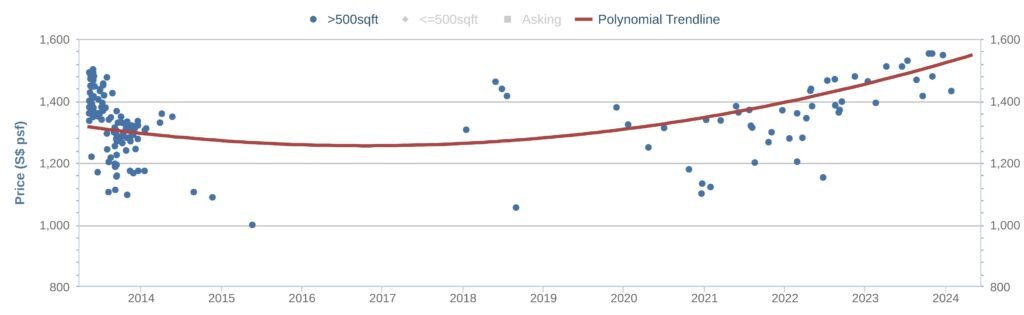

It’s gone from an average of $1,319 psf back in 2013, to $1,611 psf today; not an impressive number over 10 years. This can make it look worse than many other projects nearby. But why is this the case, when Midtown Residences is actually one of the better?

Let’s look at overall condo prices, from the time of its launch:

Note that prices were at record highs in 2013, which was a property peak. The government then imposed cooling measures to drive prices down; and this resulted in several years of weakening prices until the market adapted around 2018.

In general, condos bought near the tail-end of the last property upcycle (in 2012 and 2013) are more likely to show weaker performance, just because they were purchased at a peak. Conversely, condos purchased during downturns – such as 2016 or 2017 – are more likely to show stronger performance.

When you see that purchases fall in line with peaks or troughs, you need to take the price movement with a grain of salt. Consider that it may reflect market conditions, rather than something being “wrong” with the condo.

In fact, there are a lot of CCR condos that continue to lose money, just because the owners made their purchases in 2012 and 2013. It doesn’t mean that you cannot invest in CCR condos. You need to be savvy about the type of CCR condos to buy, the timing and other factors which are reflective of the market conditions.

Mistake #4: Comparing square footage without reading the floor plan

If a project was built sometime between 2010 to 2020, I would scrutinise the floor plans more carefully. This decade was the era of big air-con ledges, protruding bay windows, oversized balconies, and various other space-wasting features.

I don’t want to bad-mouth any specific condos; and I will say that some homeowners truly appreciate big balconies, bay windows, and planter boxes (although I know of nobody who likes big air-con ledges). However, these types of features may have been profit-maximising attempts. Simply put, the developer didn’t have to pay for the square footage of such features, but you as the buyer will have to.

Now when comparing between two units, you may find that one has 1,100 sq. ft., while the other has 900 sq. ft. However, the 1,100 sq. ft. unit is older, and 200 sq. ft. is not actually usable – it’s taken up by bay windows, a huge balcony, a long corridor, etc. The 900 sq. ft. unit may be lower in overall size, but being more efficient, it provides the same amount of living space.

In this instance, buying the bigger unit just means paying more money for 200 sq. ft. of unusable space. This is why you need to analyse the floor plan and layout, and not just compare based on the square footage.

Mistake #5: Comparing based purely on price $psf

The bigger a unit is, the lower the price $psf tends to be. Conversely, the smaller a unit, the higher the price $psf. The exception to this would be penthouses or certain premium units, which can be both bigger and have a higher price $psf.

As an example, let’s look at some transactions at The M this year. As mentioned above, this is all from the URA transaction database. I’ve picked those on roughly the same floor so we have a balanced comparison:

| Date | Address | Unit Size | Price $PSF | Total Price |

| 31 Oct 2023 | 36 Middle Road, #20-32 | 840 sq. ft. | $2,544 psf | $2.136 m |

| 29 Oct 2023 | 36 Middle Road, #20-30 | 980 sq. ft. | $2,727 psf | $2.671 m |

| 24 Oct 2023 | 36 Middle Road, #19-32 | 667 sq. ft. | $3,069 psf | $2.04 m |

| 17 Oct 2023 | 30 Middle Road #18-08 | 527 sq. ft. | $3,322 psf | $1.75 m |

There is one outlier, in that unit #20-30 is both bigger and has a higher price $psf than unit #20-32 (perhaps their agent was better at negotiating 😉 But in general, you can see the smaller units tend to have a higher price psf, albeit a lower overall price.

Because of this however, price $psf is not always a useful point of comparison, unless the two units are very similar. For example, if you are comparing two 500 sq. ft. units in the same block, then perhaps the lower price $psf suggests better overall value. But if you’re comparing between different unit types – or comparing between different property types altogether (e.g., HDB vs condo, or condo vs. landed), price $psf may be meaningless.

Mistake #6: Comparing based on outdated prices

This is somewhat related to mistake #2, in that for boutique condos, the last transaction may have been more than a year ago.

Simply put, when comparing prices, you should ensure the transaction dates are no more than 12 months apart. Anything more, and the price may no longer be relevant. Take a look at Reflections at Keppel Bay, which had a really long period of developer sales (from 2007 to 2012):

In 2012, toward the end of developer sales, the median price was $2,267 psf. Buyers who were comparing to developer prices from 2009 to 2011 may consider this expensive as prices were below $2,000 psf. However, those prices would not be relevant, as market conditions had become more buoyant, and the developer had to adjust prices upwards.

In the wider market, when comparing resale properties, we should consider that prices also get higher every year. So for a fair comparison, you do need to stick to transactions within a 12-month period.

(If it’s not possible, then as I said earlier, we will just have to go back to viewings and evaluating fundamentals)

Mistake #7: Comparing based on listing prices

This is the most common mistake among new property buyers: they will go onto various property portals, look at the listing prices, and make comparisons from there.

Do keep in mind that listing prices are only asking prices. They are not actual transactions. Not every seller is realistic, and quite often, they will ask for prices that are at least slightly above market rates. Their own agent may tell them to do this, as it’s expected that prospective buyers will try to bargain down the price.

(On the flip side, there are also some shady agents who list things with unbelievably low prices, just as a way to bait buyers to contact them.)

As such, listing prices are not very useful for comparisons at all; not unless you want to get a sense of how exuberant or confident sellers are. When you want to make property comparisons, always use URA transaction records, as these are based on the caveats filed by conveyancing firms. They reflect the mutually agreed transaction price which a seller is willing to accept and a buyer is willing to pay. Transacted prices are also the data used by industry professionals and real estate firms for valuation purposes.

Getting the price data and making comparisons can be a very involved process. For a detailed walkthrough, do reach out to me, and I can help you source for the right points of comparison. It’s worth taking the time to do it, if you’re going to be spending millions to commit to a property for several years.